Loading

Get 05-169 Texas Franchise Tax E-z Computation Annual Report - Window State Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

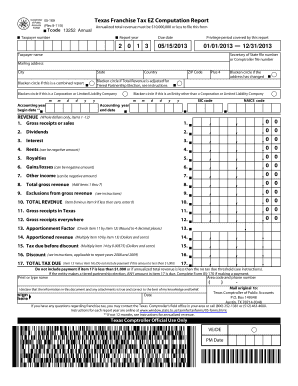

How to fill out the 05-169 Texas Franchise Tax E-Z Computation Annual Report - Window State Tx online

Filling out the 05-169 Texas Franchise Tax E-Z Computation Annual Report accurately is crucial for compliance with state tax regulations. This guide will walk you through each section of the form, ensuring you complete it correctly and efficiently online.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in your designated editor.

- Enter your taxpayer number in the designated field. This is a unique identifier assigned to your business.

- Specify the report year for which you are filing the report. Include the due date for submission.

- Indicate the privilege period covered by this report by entering the start and end dates.

- Provide your taxpayer name, mailing address, city, state, country, and ZIP code.

- Check the appropriate boxes; indicate if this is a combined report, if total revenue is adjusted for tiered partnership election, or if the entity is a corporation or limited liability company.

- If your address has changed, mark the corresponding box to indicate this update.

- Fill in your Standard Industrial Classification (SIC) code and North American Industry Classification System (NAICS) code.

- State your accounting year end date.

- For revenue reporting, proceed to fill in the gross receipts, dividends, interest, rents, royalties, gains/losses, other income, and calculate total gross revenue by adding items 1 through 7.

- Complete the exclusions from gross revenue and calculate total revenue by subtracting exclusions from gross revenue.

- Input the gross receipts in Texas and the gross receipts everywhere.

- Calculate the apportionment factor by dividing gross receipts in Texas by gross receipts everywhere.

- Determine apportioned revenue by multiplying total revenue by the apportionment factor.

- Calculate the tax due before discounts by applying the tax rate.

- Subtract any applicable discounts from the tax due before discount to determine total tax due.

- Sign and date the form, confirming the information provided is true and correct.

- Save your changes, download, print, or share the completed form as needed.

Complete your franchise tax documents online today to ensure timely and accurate filing.

A nonprofit corporation organized under the Development Corporation Act of 1979 (Article 5190.6, Vernon's Texas Civil Statutes) is exempt from franchise and sales taxes. The sales tax exemption does not apply to the purchase of an item that is a project or part of a project that the corporation leases, sells or lends.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.