Loading

Get 1040n V

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040n V online

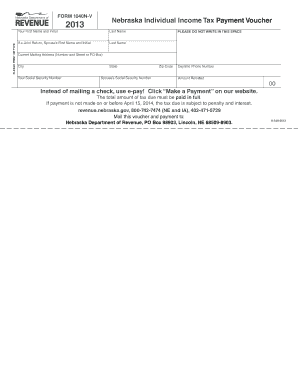

The 1040n V is the Nebraska individual income tax payment voucher designed for taxpayers to submit payments accurately and efficiently. This guide will assist you in completing the form online, ensuring a smooth filing experience.

Follow the steps to fill out the 1040n V online

- Press the ‘Get Form’ button to retrieve the form and open it in the online editor.

- Enter your first name and initial in the designated fields, ensuring the information is accurate and clearly typed.

- Fill in your last name as indicated, making sure it matches your official documents.

- If applicable, provide your spouse’s first name and initial next to the 'If a Joint Return' section.

- Complete the last name field for your spouse, ensuring consistency with their identification.

- Input your current mailing address, including the number and street or PO Box, city, state, and zip code.

- Enter your Social Security number to identify your tax records accurately.

- Include your spouse’s Social Security number if filing jointly.

- Provide a daytime phone number where you can be reached, in case of inquiries regarding your submission.

- Indicate the amount you are remitting for your tax payment, ensuring it reflects the total due.

- Review all entered information for accuracy before proceeding.

- Once complete, choose an option to save changes, download, print, or share the filled form to maintain your records.

Begin filling out your 1040n V online today!

The Nebraska income tax rate paid by individuals in the highest tax brackets decreases from 6.64% for the 2023 tax year to: 6.44% for the 2024 tax year; 6.24% for the 2025 tax year; 6.00% for the 2026 tax year; and.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.