Loading

Get Ssa-783 - Social Security Administration

This website is not affiliated with any governmental entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-783 - Social Security Administration online

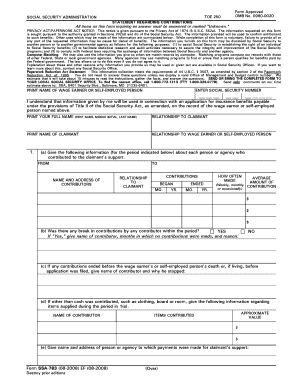

The SSA-783 form is essential for providing a statement regarding contributions to a claimant's support. This guide offers step-by-step instructions to help users effectively fill out the form online, ensuring a smooth application process for benefits.

Follow the steps to complete the SSA-783 online.

- Click ‘Get Form’ button to obtain the SSA-783 form and open it in the editor.

- Begin by entering the name of the wage earner or self-employed person in the designated field. Next, input the Social Security number associated with the new application.

- Provide your full name along with the relationship to the claimant, ensuring proper identification of your role.

- Fill in the claimant's full name and specify the relationship to the wage earner or self-employed person by referring to the appropriate section.

- Item 1 requires listing all contributors to the claimant's support. For each, include the name and address, the periods during which contributions were made, their relationship to the claimant, how often they contributed, and the average amount contributed.

- Indicate if there was any break in contributions during the specified periods by selecting 'Yes' or 'No.' If 'Yes,' provide details of the contributor and months in which contributions were not made.

- If any contributions ended prematurely, specify the contributor and the reason for the cessation of contributions.

- In relation to non-cash contributions, provide details about these items, including the name of the contributor and an approximate value of the items supplied.

- Answer the questions regarding the claimant's own wages or income if applicable, including the amount per month and the specific months received.

- If the claimant is a child living with multiple parents, answer the relevant questions regarding combined contributions and parental agreements.

- Conclude by signing the form in ink, providing the date, contact number, and mailing address.

- If the form is signed by mark (X), ensure two witnesses sign with their addresses provided. When finished, save your changes, and you can download, print, or share the form as needed.

Complete your SSA-783 form online today to ensure your application for benefits is processed smoothly.

If you're younger than full retirement age, there is a limit to how much you can earn and still receive full Page 3 2 Social Security benefits. If you're younger than full retirement age during all of 2020, we must deduct $1 from your benefits for each $2 you earn above $18,240.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.