Loading

Get Required Minimum Distribution Election Form - Ameritas Life ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Required Minimum Distribution Election Form - Ameritas Life online

Filling out the Required Minimum Distribution Election Form is an essential step for managing your retirement distributions effectively. This guide provides clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the Required Minimum Distribution Election Form and open it for filling out.

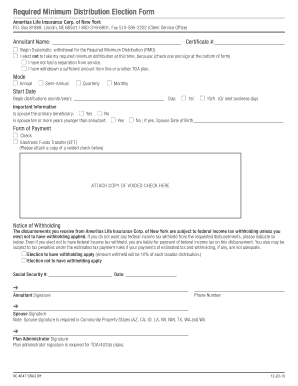

- Fill out the Annuitant Name and Certificate Number fields. Ensure that all personal information is entered accurately.

- Select whether you want to begin systematic withdrawals for the Required Minimum Distribution (RMD) or elect not to take the distribution at this time. If you choose not to take the distribution, check the appropriate reason provided.

- Choose the Mode of withdrawal: Annual, Semi-Annual, Quarterly, or Monthly. Specify the start date for your distributions.

- Indicate whether your spouse is the primary beneficiary and confirm if they are ten or more years younger than you, providing their date of birth if applicable.

- Select your preferred form of payment: Check or Electronic Funds Transfer (EFT). If you choose EFT, attach a voided check in the designated area.

- Review the Notice of Withholding section and elect to have withholding applied or not. If withholding is selected, please note that 10% will be withheld from each taxable distribution.

- Enter your Social Security Number and the date before signing the form.

- Provide the required signatures: your signature, your spouse's signature if applicable, and, if necessary, the Plan Administrator's signature.

- Once you have filled out all sections and reviewed the information for accuracy, save changes, download, print, or share the form as needed.

Complete your Required Minimum Distribution Election Form online to manage your retirement savings effectively.

The RMD age changes again in 2033 from 73 to 75. SECURE 2.0, effective for distributions made after December 31, 2022, increases the RMD age to 73 for those IRA owners (including SEP and SIMPLE, but not Roth IRAs) who turn 72 after December 31, 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.