Loading

Get Chet Advisor Incoming Rollover/transfer Form - Hartford Funds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CHET Advisor Incoming Rollover/Transfer Form - Hartford Funds online

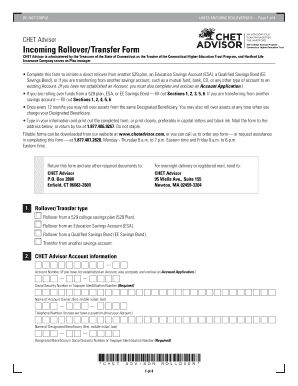

The CHET Advisor Incoming Rollover/Transfer Form is essential for initiating a direct rollover or transfer to your CHET Advisor account. This guide will provide you with step-by-step instructions to complete the form online with confidence.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to obtain the CHET Advisor Incoming Rollover/Transfer Form and open it in your preferred editor.

- In Section 1, indicate the type of rollover or transfer you are initiating by selecting the appropriate option. This may include a transfer from another 529 Plan, an Education Savings Account, or a savings account.

- Complete Section 2 by providing your CHET Advisor account information. This includes your account number, Social Security Number or Taxpayer Identification Number, name of the account owner, phone number, name of the designated beneficiary, and their Social Security Number or Taxpayer Identification Number.

- In Section 3, provide details regarding your current 529 program manager or ESA custodian. This includes the account number and the contact information of the institution holding your assets.

- If transferring from a different financial institution, complete Section 4 with the savings account information, including the name, address, and phone number of the institution.

- In Section 5, choose whether you wish to rollover or transfer all assets or only a portion of the assets to CHET Advisor. Provide details as necessary for the chosen accounts.

- Sign the form in Section 6. If required by your current program manager or custodian, obtain a Medallion Signature Guarantee in the presence of an authorized financial institution officer.

- Section 7 is for authorization and acceptance by CHET Advisor and does not require action from you. Review the entire form for accuracy.

- Once completed, you can save changes, download, print, or share the form as needed before submission.

Start filling out your CHET Advisor Incoming Rollover/Transfer Form online today to ensure a smooth transfer process.

Beginning in 2024, beneficiaries of 529 accounts will have the option to roll over up to $35,000 over the course of their lifetime to their Roth IRA . Rollovers are subject to Roth IRA annual contribution limits, and the 529 account must have been open for more than 15 years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.