Loading

Get Distribution Request - Qrp - 211 - 72 Financial

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Distribution Request - QRP - 211 - 72 Financial online

This guide provides a systematic approach to completing the Distribution Request - QRP - 211 - 72 Financial form online. By following these steps, users can efficiently navigate the form and ensure they provide all necessary information accurately.

Follow the steps to complete the Distribution Request form online.

- Click the ‘Get Form’ button to obtain the distribution request form. This will enable you to open it in your preferred editor.

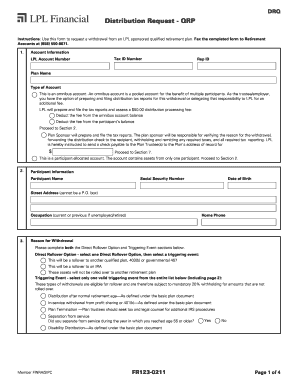

- Complete the Account Information section by entering your LPL Account Number, Tax ID Number, and Representative ID. Specify the plan name and the type of account—either omnibus account or participant-allocated account.

- In the Participant Information section, fill out your name, Social Security Number, date of birth, street address (not a P.O. box), and occupation.

- In the Reason for Withdrawal section, select a direct rollover option and a triggering event relevant to your situation. Ensure you follow the specific instructions regarding tax implications for each option.

- Specify the Distribution Options, indicating whether you want a total or partial distribution and provide the amount or details regarding in-kind distributions.

- Select your Method of Distribution. Choose how you would like to receive your distribution (e.g., check, electronic funds transfer, etc.), and provide any necessary details such as bank information if applicable.

- In the Tax Withholding section, elect whether to withhold federal and state income taxes. Details are provided regarding mandatory withholding based on your selections.

- Finally, complete the Employer Signature & Certification and the Validation of Signature sections where applicable. Ensure all required signatures are provided to validate the request.

- Once you have filled out all sections, save your changes, download the completed form, and print or share it as necessary.

Complete your Distribution Request online today to ensure timely processing of your withdrawal.

This form is to request a participant withdrawal from your retirement account with your employer. Whether you are rolling over the funds or taking a cash payment, you will need to review the Special Tax Notice included at the end of this form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.