Loading

Get Auto Physical Damage Application - Willis Programs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Auto Physical Damage Application - Willis Programs online

Completing the Auto Physical Damage Application is an important step in securing insurance coverage for your vehicle inventory. This guide will provide you with clear instructions on how to navigate and fill out the form online, ensuring that you supply all necessary information accurately and efficiently.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to access the application form and open it in your preferred online editor.

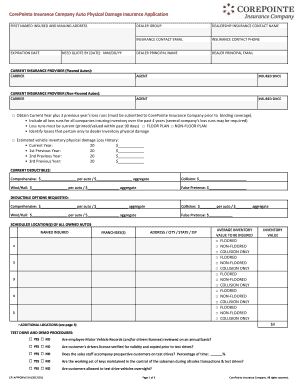

- Begin by filling in the 'First Named Insured and Mailing Address' section. Include the name of the primary insured party, their contact details, and the mailing address.

- Specify the expiration date of the current policy and the date by which you need a quote, formatted as MM/DD/YY.

- In the 'Dealership Information' section, provide the dealer group name, dealership insurance contact, and their relevant email and phone number. Additionally, include the name and contact details of the dealer principal.

- Fill in details about the current insurance provider for both floored and non-floored autos, including the carrier name, agent, and how long the insurance has been in place.

- Indicate whether you wish to obtain the current year plus three previous years of loss runs. Ensure this is done for all companies insuring your inventory over the past four years.

- Provide the estimated vehicle inventory physical damage loss history for the current year and the three previous years, including monetary values for each year.

- Outline your current deductibles for comprehensive coverage, collision, wind/hail, and false pretense.

- Request deductible options by specifying amounts you desire for comprehensive, collision, wind/hail, and false pretense coverage.

- List the scheduled locations of all owned autos, including addresses along with average inventory values to be insured.

- Address the security measures in place at the dealership, confirming if surveillance cameras and alarm systems are operational.

- Review and answer questions regarding key control procedures and vehicle security, ensuring you provide accurate responses.

- Complete the section on loss control initiatives, detailing your protocols for investigating accidents and maintaining a loss prevention program.

- If there are any unique vehicles that need special consideration, list them along with their details.

- Finalize the application by obtaining necessary signatures from the dealership representative and insurance agent, and date the document.

- Once you have filled out all sections and verified their accuracy, save the changes, and choose to download, print, or share the completed form as needed.

Complete your application online today for a streamlined filing process.

Related links form

A Hired Auto Physical Damage policy covers damage done to the vehicle itself while you rent it. Sometimes the company renting the vehicle to you will give you the option to go under their insurance for this type of coverage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.