Loading

Get Form 458

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 458 online

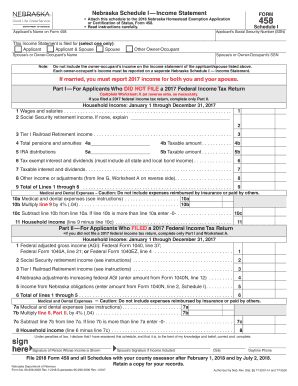

Filling out the Form 458 online is a straightforward process that requires careful attention to detail. This guide will walk you through each section of the form to ensure your submission is accurate and complete.

Follow the steps to fill out the Form 458 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editing tool.

- Fill in the applicant's name and social security number in the designated fields. Ensure accuracy to avoid delays.

- Select the appropriate option regarding who the income statement is for: Applicant, Applicant & Partner, Partner, or Other Owner-Occupant.

- If applicable, enter the spouse’s or other owner-occupant’s name and social security number.

- For applicants who did not file a 2017 federal income tax return, complete Part I, detailing household income sources like wages, social security, and other types of income.

- If you filed a 2017 federal income tax return, fill out Part II with your Federal adjusted gross income, social security income, and other adjustments.

- Calculate and enter the total household income as required in both parts of the form.

- Carefully review all the information entered for accuracy.

- Once completed, save changes to your form. You can also download, print, or share it as needed.

Complete your Form 458 online today to ensure your homestead exemption application is processed efficiently.

In Nebraska, a homestead exemption is available to the following groups of persons: • Persons over the age of 65; • Qualified disabled individuals; or • Qualified disabled veterans and their widow(er)s. Some categories are subject to household income limitations and residence valuation requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.