Loading

Get Form 13e - Nebraska Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13E - Nebraska Department Of Revenue online

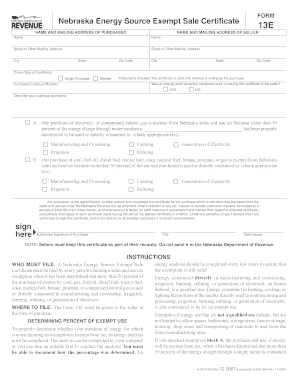

Filling out the Form 13E - Nebraska Department of Revenue is an essential step for users seeking a sales and use tax exemption on energy purchases. This guide provides a clear and supportive walkthrough of each component of the form, ensuring users can complete it accurately and confidently.

Follow the steps to complete the Form 13E successfully.

- Click ‘Get Form’ button to obtain the Form 13E and open it in your editor.

- Fill in the name and mailing address of the purchaser in the designated fields. Ensure the information is accurate and complete.

- Input the name and mailing address of the seller in the appropriate section.

- Check the type of certificate by selecting either 'Single Purchase' or 'Blanket'. If 'Blanket' is selected, this certificate is valid until revoked in writing.

- Indicate whether an energy audit was completed prior to issuing this certificate by selecting 'Yes' or 'No'.

- Provide the purchaser’s account number in the designated field.

- Describe your business operations in detail. This information helps justify the claim for exemption.

- Check the appropriate box that indicates the exemption category of the energy purchase: either 'Manufacturing and Processing,' 'Farming,' 'Irrigation,' 'Refining,' or 'Generation of Electricity'.

- Ensure that an authorized person signs the certificate in the designated area.

- Enter the title and the date the certificate is issued in the appropriate fields.

- Once you have filled in all the fields, review the document for accuracy. You may then save changes, download, print, or share the completed form as needed.

Complete your Form 13E online today for seamless processing of your tax exemption.

The Nebraska Form W-4N was developed due to significant differences between the federal and Nebraska laws regarding standard deductions and because personal exemptions credits are allowed on the Nebraska return. ... Complete Form W-4N so your employer can withhold the correct Nebraska income tax from your pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.