Loading

Get Value Added Tax Return Form Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Value Added Tax Return Form Pdf online

Filling out the Value Added Tax Return Form Pdf can be a straightforward process if you understand each component and section of the form. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete your Value Added Tax Return Form Pdf online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred PDF editor.

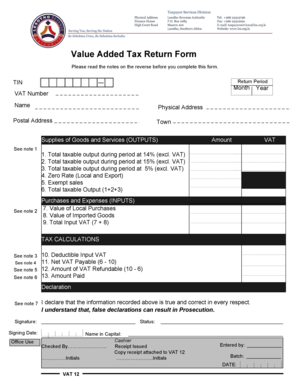

- Enter the return period, including the month and year, as well as your Tax Identification Number (TIN) and VAT number at the top of the form.

- Provide your name, physical address, postal address, and town to ensure proper identification.

- In the 'Supplies of Goods and Services (Outputs)' section, enter the total taxable output during the period at different VAT rates: 14%, 15%, and 5%, excluding VAT.

- Record any zero-rated sales and exempt sales, then calculate the total taxable output by summing sections 1 through 5.

- In the 'Purchases and Expenses (Inputs)' section, input the value of local purchases and the value of imported goods to determine the total input VAT.

- Calculate the deductible input VAT and determine the net VAT payable by subtracting the deductible input VAT from the total taxable output.

- In the 'Tax Calculations' section, check if there is an amount of VAT refundable and input the amount paid on your return.

- Complete the declaration section, ensuring that you understand the legal implications of the information provided.

- Finally, save your changes, then download, print, or share the form as needed.

Start filling out your Value Added Tax Return Form Pdf online today to ensure compliance and accuracy.

Customers can buy VAT forms at any VAT offices (Ramstein, Stuttgart, etc., and turn in at any office). Therefore it is recommended, especially when traveling, for a customer to leave two or three forms in the system (not purchasing all 10 at once), so they can pick up one at the nearest VAT office.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.