Loading

Get Sad 500

How it works

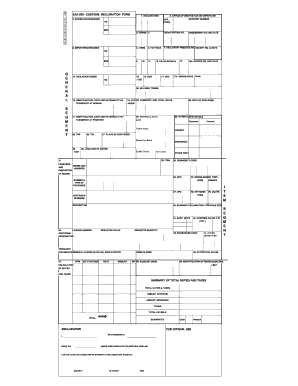

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sad 500 online

This guide provides clear, step-by-step instructions for filling out the Sad 500 customs declaration form online. Whether you are an experienced user or new to the process, this guide will help ensure that your submission is accurate and complete.

Follow the steps to successfully complete the Sad 500 form online.

- Press the ‘Get Form’ button to access the Sad 500 form and open it in your preferred editor.

- Begin by filling in the office of destination or departure, including the office code and manifest number. Make sure to provide accurate details to facilitate processing.

- Complete the exporter/consignor section with your registration number, assessment number, and date. Accurate information is crucial for customs verification.

- Continue to the items section, where you will need to indicate the total number of packages and any relevant reference numbers, including the declarant's reference number.

- In the importer/consignee section, enter the taxpayer identification number (TIN) and any other required details about the recipient of the goods.

- Provide value details, including the invoice number and date, and outline the delivery terms associated with this shipment.

- Fill in identification details for transport, including the date and nationality of the transport at arrival. This information is fundamental for customs tracking.

- Enter the gross mass, net mass, and details about the packaging type and numbers. Be precise to avoid delays at customs.

- Complete the declaration section, affirming that the particulars provided are true and correct. Ensure that the signature and date are included for verification.

- Once all fields are filled and verified for accuracy, save any changes made, download a copy for your records, or print it out for submission.

Start filling out your Sad 500 form online today to ensure a smooth customs declaration process.

The Customs Declaration Form (SAD 500) is a South African document required by the South African Revenue Service (SARS). The purpose of this document is to ensure that exported goods are properly declared to SARS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.