Loading

Get Kra Vat4 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kra Vat4 Form online

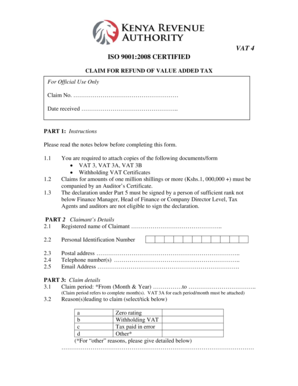

The Kra Vat4 Form is designed for individuals and businesses seeking a refund of value added tax. Completing this form online can facilitate a smoother submission process and ensure that all necessary details are captured accurately.

Follow the steps to fill out the Kra Vat4 Form online

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin with Part 2, Claimant’s Details. Fill in your registered name, personal identification number, postal address, telephone numbers, and email address.

- Proceed to Part 3, Claim details. Indicate the claim period by entering the start and end month and year. Remember to attach the appropriate VAT 3A forms for the periods claimed.

- Select the reason for your claim from the provided options in Part 3. If choosing 'Other', be sure to provide a detailed explanation in the space given.

- In Part 3.3, specify the amount you are claiming. Write the amount both in words and in figures, ensuring accuracy to prevent delays.

- Move to Part 4 and enter your bank details including account name, account number, bank name, bank branch, and city/town. This information will direct where the refund will be deposited.

- Finalize the form by completing Part 5, Declaration. Ensure that the declaration is signed by an authorized individual, not below the level of Finance Manager, Head of Finance, or Company Director.

- Once all sections are complete, you can save the changes, download, print, or share the completed form as needed.

Start filling out your Kra Vat4 Form online today to ensure a hassle-free refund process.

You must use the form VAT484 to tell HMRC within 21 days if you take over the VAT responsibilities of someone who has died or is ill and unable to manage their own affairs. You must include the details of the date of death or the date the illness started.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.