Loading

Get Colorado Department Of 1260 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Colorado Department Of 1260 Form online

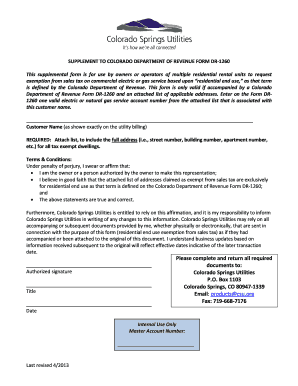

Filling out the Colorado Department Of 1260 Form online is an essential step for owners or operators seeking an exemption from sales tax on commercial electric or gas services based on residential end use. This guide will walk you through each section of the form, ensuring a smooth and efficient process.

Follow the steps to complete the Colorado Department Of 1260 Form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Carefully enter your customer name as it appears on your utility bill. This field is required.

- Attach a list of addresses for all qualifying residential units. Ensure the full addresses are included, which should encompass the street number, building number, apartment number, etc.

- Identify and enter one valid electric or natural gas service account number from the attached addresses into the Form DR-1260. This number must be associated with the customer name you have provided.

- Review the terms and conditions section carefully and verify that you meet the requirements to make this representation. You will need to affirm your ownership or authorization status.

- Provide your authorized signature in the designated area, ensuring it is dated appropriately and includes your title.

- Once all fields are completed, you can save your changes, download the completed form, print it, or share it as needed.

Complete your documents online for a hassle-free experience!

Colorado statute exempts from state and state-collected sales tax all sales to the United States government and the state of Colorado, its departments and institutions, and its political subdivisions (county and local governments, school districts and special districts) in their governmental capacities only (§39-26- ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.