Loading

Get Form Vat616

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Vat616 online

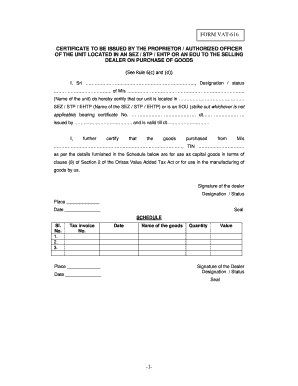

Filling out the Form Vat616 online is an essential process for businesses operating in specific economic zones. This guide provides clear, step-by-step instructions to help you accurately complete the form and ensure your purchases are properly documented.

Follow the steps to complete the Form Vat616 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your designation or status in the designated field at the top of the form. This identifies your role within the organization completing the form.

- Next, provide the name of your unit in the appropriate box. Be sure to check spelling for accuracy, as this information is vital for identification.

- Specify the location of your unit by selecting the relevant option: SEZ, STP, EHTP, or EOU. Strike out the option that does not apply to your unit.

- Enter the certificate number and issue date in the provided fields. Ensure that these details match the official documentation you possess.

- In the certification statement, clearly identify the name of the selling dealer from whom goods were purchased. Input their TIN number accurately to avoid any discrepancies.

- Proceed to the schedule section of the form. Here, list the details of the purchased goods, including the tax invoice number, date of the invoice, name of the goods, quantity, and total value.

- After filling out all required fields, review your entries for any errors or omissions. Accuracy is crucial to ensure compliance and proper documentation.

- Finally, you can save your changes, download the filled form, print it, or share it as needed for your records or further action.

Start filling out your documents online today for a seamless experience.

The VAT126 is used by certain bodies who are not registered for VAT, in order to claim back VAT. This includes local authorities and similar bodies, academies, certain charities and non-departmental bodies or similar public bodies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.