Loading

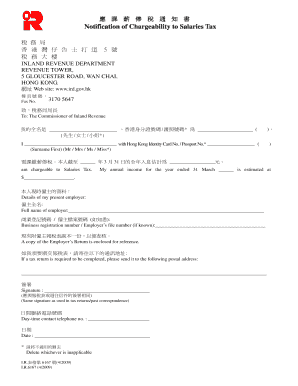

Get Notification Of Chargeability To Salaries Tax Notification Of Chargeability To Salaries Tax - Ird

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notification Of Chargeability To Salaries Tax online

Filling out the Notification Of Chargeability To Salaries Tax form accurately is crucial for your tax obligations. This guide will walk you through each section of the form, ensuring you complete it correctly and efficiently.

Follow the steps to fill out the form correctly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your full name in the designated field, alongside your Hong Kong Identity Card number or Passport number.

- Indicate whether you are male, female, or if you prefer other identifiers by choosing the appropriate option.

- State your chargeability status for salaries tax by affirmatively indicating that you are chargeable.

- Enter your estimated annual income for the year ending 31 March in the specified field.

- Fill out the details of your current employer, including the full name and, if known, the business registration number or employer’s file number.

- Attach a copy of the Employer’s Return for reference, as instructed in the form.

- If a tax return is necessary, provide your preferred postal address where it should be sent.

- Sign the form in the designated area, ensuring that the signature matches your previous tax returns or correspondence.

- Enter your daytime contact telephone number in the appropriate field for follow-up communications.

- Finally, date the form, confirming the date of completion.

- After completing all sections, you can save the changes, download the form, print it, or share it as needed.

Complete your documents online today for a smooth filing experience.

If payment vouchers are printed with barcode, you can present the voucher and pay tax, Business Registration Fee and e-Stamping payment at any 7-Eleven Convenience Store, Circle K Convenience Store, VanGO Convenience Store and U select in Hong Kong. Cash payment up to HK$5,000 per transaction is accepted.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.