Loading

Get Ird 56b Software

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ird 56b Software online

Filling out the Ird 56b Software can seem complex, but with clear guidance, you can navigate through the process with ease. This guide provides step-by-step instructions to help you complete the form online efficiently.

Follow the steps to complete the Ird 56b Software form online.

- Press the ‘Get Form’ button to access the form and open it in your chosen online editor.

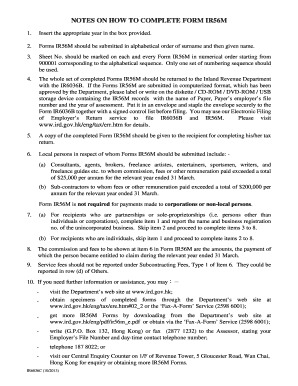

- In the first section, enter the appropriate year in the designated box. Make sure this reflects the relevant assessment year.

- Arrange the Forms IR56M in alphabetical order by surname followed by given name. This will facilitate easier processing.

- Label each Form IR56M with a unique sheet number, starting from 900001 and continuing in numeric order corresponding to the alphabetical sequence.

- Submit the complete set of IR56M forms to the Inland Revenue Department together with the IR6036B form. If filing electronically, ensure that your storage device is labeled with the payer's name, employer's file number, and assessment year.

- Ensure that a copy of the completed Form IR56M is given to the recipient, as they will need it for their own tax return.

- Determine the appropriate recipient category: for partnerships or sole proprietorships, complete item 1; for individuals, skip to item 2.

- In item 6, report the commissions and fees that the recipient became entitled to during the assessment year.

- When reporting service fees, do not list them under subcontracting fees; rather, use the designated row for others.

- Once all fields are filled out, review your form for accuracy. You can then save changes, download, print, or share the completed IR56M form as needed.

Start completing your Ird 56b Software form online today to ensure timely submissions.

The Employer's Return of Remuneration and Pensions, or known simply as the employer's return, is an annual form that states what your employees receive in salary and benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.