Loading

Get Kern County Preliminary Change Of Ownership Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kern County Preliminary Change Of Ownership Form online

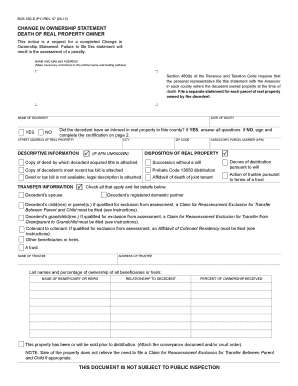

Filling out the Kern County Preliminary Change Of Ownership Form online is an important step in reporting changes in property ownership due to the death of a real property owner. This guide provides clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the pre-printed name and mailing address on the form. Make any necessary corrections to ensure accuracy.

- Provide the name of the decedent and their date of death. Indicate whether the decedent had an interest in real property in this county by selecting 'YES' or 'NO'. If 'YES', proceed to answer all subsequent questions.

- Complete the section regarding the street address, city, and zip code of the real property. If the Assessor’s Parcel Number (APN) is unknown, indicate this by checking the appropriate box.

- In the disposition of real property section, check the applicable options based on the documentation you have regarding the decedent's ownership of the property.

- Fill out the transfer information section, stating the relationship of the owner to the decedent and listing any applicable claims for reassessment exclusion, if applicable.

- If the decree of distribution involves legal entities or leases, provide the necessary details as requested in the relevant sections.

- Ensure you include the mailing address for future property tax statements, if different from the mailing address already provided.

- Complete the certification section by signing, printing your name, and providing your contact information. Verify that all information is accurate and complete.

- Once you have filled out the form, you can save your changes, download the document, print it, or share it as necessary.

Complete your documents online to ensure a smooth filing process.

What Is The Purpose of A PCOR? A PCOR allows the county tax assessor to properly assess taxes on properties. It also provides the assessor with a mailing address for tax statements. From the PCOR, the county assessor is able to determine which properties require reappraisal under the law (i.e., Proposition 13).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.