Loading

Get R-1201 (1/13) Web Fourth Quarter Employer S Return Of Louisiana Withholding Tax Form L1 Mail Your

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R-1201 (1/13) WEB Fourth Quarter Employer S Return Of Louisiana Withholding Tax Form L1 online

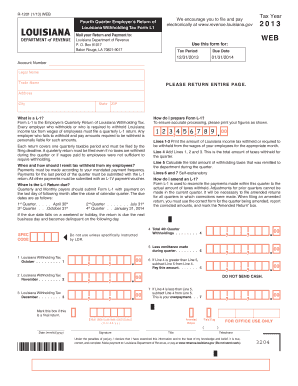

Filing the R-1201 (1/13) WEB Fourth Quarter Employer S Return of Louisiana Withholding Tax Form L1 is essential for employers to report taxes withheld from employee wages. This guide offers clear, step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete the R-1201 (1/13) form online.

- Press the ‘Get Form’ button to access the form, which will open in the editor for you to fill out.

- Enter your account number in the designated field. This is essential for accurate identification of your tax records.

- Indicate the tax period and due date for the submission. For this form, the tax period is the fourth quarter, ending on December 31, 2013, and the due date is January 31, 2014.

- After double-checking all entries, save your changes, and either download, print, or share the completed form as required for your records.

Complete the R-1201 (1/13) WEB form online today to ensure timely filing and compliance with Louisiana withholding tax requirements.

Withholding Formula (Effective Pay Period 03, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $12,5001.85%Over $12,500 but not over $50,000$231.25 plus 3.50% of excess over $12,500Over $50,000$1,543.75 plus 4.25% of excess over $50,000 Feb 25, 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.