Loading

Get Rpg In-service Distribution Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RPG In-Service Distribution Request Form online

This guide aims to provide clear and supportive instructions for completing the RPG In-Service Distribution Request Form online. By following the outlined steps, you will be equipped to accurately fill out the necessary information for your in-service distribution request.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to access the RPG In-Service Distribution Request Form and open it in your editor.

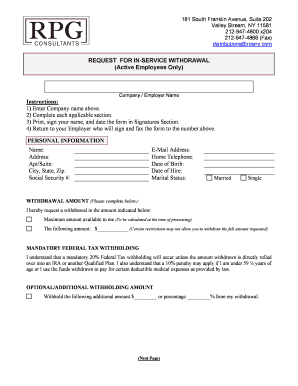

- In the first section, enter the name of your company or employer in the designated field at the top of the form.

- Proceed to the personal information section. Fill in your name, address, apartment/suite number (if applicable), city, state, zip code, social security number, email address, home telephone number, date of birth, date of hire, and marital status.

- Next, indicate the withdrawal amount you are requesting. You can either select the maximum amount available or specify a certain dollar amount in the indicated field. Be aware of potential restrictions on your requested withdrawal.

- Review the mandatory federal tax withholding information carefully. A 20% federal tax withholding applies unless you roll over the withdrawal into an IRA or another qualified plan. If applicable, consider whether a 10% penalty may apply in your case.

- If you wish to withhold an additional amount on your withdrawal, complete this section by specifying the additional dollar amount or percentage.

- Fill out the section for where your money will be sent. Provide a check payable to, mailing address, account number, and any other information as required.

- If opting for direct deposits, enter the bank name and address, routing (ABA) number, account number, and select whether it is a checking or savings account.

- Address the spousal consent section. If you are married, ensure that your spouse completes and signs this section in the presence of a notary public. If you have no spouse, your spouse cannot be located, or your account balance is less than $5,000, you may check the appropriate box.

- Both the participant and employer/plan trustee must print their names, sign the signatures section, and date their entries.

- Finally, review all information entered for accuracy. Once all sections are complete, you can save changes, download, print, or share the completed form as needed.

Complete your RPG In-Service Distribution Request Form online today to ensure a smooth processing of your withdrawal.

Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. You should receive a copy of Form 1099-R, or some variation, if you received a distribution of $10 or more from your retirement plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.