Loading

Get 004052-pdf Layout. Retirement Plans Distribution Form For Retirement Accounts, Rmd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 004052-pdf Layout. Retirement Plans Distribution Form For Retirement Accounts, RMD online

Filling out the 004052-pdf Layout is an essential step for individuals seeking to manage their retirement funds and distributions effectively. This guide will provide structured, step-by-step instructions to ensure users complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

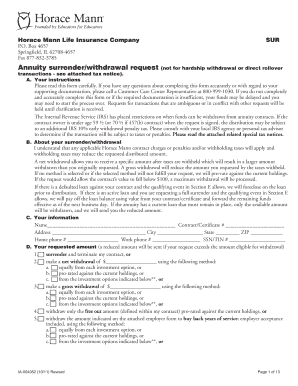

- Read the instructions at the top of the form carefully to understand the requirements and necessary documentation needed for your specific distribution request.

- Provide your personal information in Section C, which includes your name, address, contact numbers, and Social Security number or Tax Identification Number.

- In Section D, specify your requested amount by choosing between surrendering the contract, making a gross withdrawal, or opting for a net withdrawal. Follow the instructions provided for each option to decide the method that best suits your needs.

- Complete Section E by selecting the reason for your request, from age qualifications to severance from employment, and ensure you provide any required supporting documentation.

- Fill out Section F regarding tax withholding elections. Make sure to note any federal and state income tax requirements relevant to your withdrawal.

- In Section G, choose your method of receiving your funds, such as by check or direct deposit, and provide the necessary bank information if choosing direct deposit.

- Sign and date the form in Section H, ensuring that you understand the information provided and that all information is accurate. If required, have your partner or plan administrator also sign.

- Review the entire form for completeness and accuracy before submitting it to avoid processing delays.

- After completing the form, save the changes, then download, print, or share the completed form as needed.

Complete your retirement distribution form online today and secure your financial future.

What types of retirement plans require minimum distributions? profit-sharing plans, 401(k) plans, 403(b) plans, and 457(b) plans. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs, SARSEPs, and SIMPLE IRAs. The RMD rules also apply to Roth 401(k) accounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.