Loading

Get Morgan Stanley Ira Distribution Form 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Morgan Stanley IRA Distribution Form 2019 online

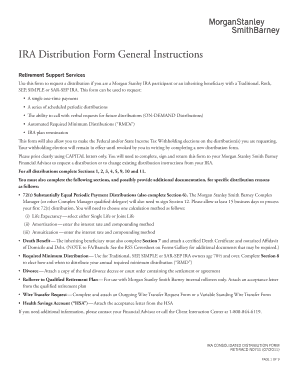

Filling out the Morgan Stanley IRA Distribution Form 2019 online is a straightforward process designed for users requesting distributions from their Individual Retirement Accounts. This guide provides step-by-step instructions to ensure users can complete the form accurately and efficiently.

Follow the steps to successfully complete your distribution request.

- Press the ‘Get Form’ button to access the IRA Distribution Form and open it for editing.

- Begin by selecting the type of IRA you have in Section 1, indicating if it is a Traditional IRA, Roth IRA, SEP/SAR-SEP/SIMPLE IRA, or an Inherited IRA.

- In Section 2, provide your payee information. Fill out your name, social security number, address, city, state, ZIP code, and date of birth. Specify whether you are the IRA owner or the beneficiary.

- In Section 3, indicate the withdrawal amount. Check the corresponding box for whether it is a gross amount, a one-time payment, or a periodic payment. For periodic payments, choose the frequency such as monthly, quarterly, semi-annual, or annual and provide the start date.

- Select a reason for withdrawal in Section 4. Review the list and check one, such as normal distribution, first-time home purchase, or other qualifying reasons.

- In Section 5, choose the method of distribution. Options include automated check, local branch check, direct deposit, or wire transfer. Provide necessary account details if selecting direct deposit.

- If applicable, complete Section 6 for 72(t) substantially equal periodic payments. Select the distribution method that aligns with your preference—life expectancy, amortization, or annuitization—and input required details.

- Complete Section 7 if you are a beneficiary applying for a death benefit. Provide the date of death of the IRA owner and select an option for the type of rollover or transfer.

- If selecting required minimum distributions, fill out Section 8 to indicate your payment frequency and calculation election.

- In Sections 9 and 10, choose your federal and state income tax withholding elections. You can indicate whether to withhold taxes and at what percentage.

- Finally, complete Section 11 by signing the payee certification where you warrant the accuracy of the information provided. Include the date of signature.

Start completing your forms online today to ensure timely processing of your IRA distribution request.

Use Form 5329 to report additional taxes on IRAs and retirement plans, including: tax on an early distribution.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.