Loading

Get The Simple Ira Employer Guide - Alliancebernstein

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the The SIMPLE IRA Employer Guide - AllianceBernstein online

Filling out the The SIMPLE IRA Employer Guide - AllianceBernstein can be a straightforward process when you follow the right steps. This guide will provide detailed instructions aimed at helping users of all experience levels to complete the form efficiently.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the document and view it in your preferred tool.

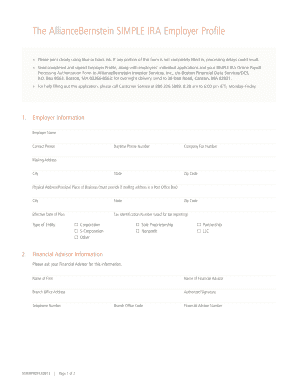

- Begin filling out the Employer Information section. This includes your employer's name, contact person, daytime phone number, and mailing address. Ensure that you print clearly using blue or black ink.

- Proceed to the Financial Advisor Information section. Fill out the necessary details such as the name of the firm and the financial advisor's contact information.

- In the Signature section, declare your authority by signing and dating the form. This certifies that you are eligible to establish the SIMPLE IRA plan and will provide required documentation to employees.

- Complete the SIMPLE IRA Online Payroll Processing Authorization Form with all requested information, including the employer’s address and contact details. Mail this form along with the Employer Profile and Employee SIMPLE IRA applications to the address provided.

- Once the forms are processed, you will receive a confirmation letter. Follow the instructions to initialize your User Identification Number (UIN) for conducting online transactions.

- Make sure to photocopy all completed materials for your records before submission.

- Finalize the process by verifying that all contributions, deductions, and necessary documentation are in order to ensure compliance with the SIMPLE IRA plan.

Get started by filling out the SIMPLE IRA Employer Guide - AllianceBernstein online today.

Annual Employee SIMPLE IRA Contribution This calculation is done by multiplying your SIMPLE IRA deferral percentage by your annual compensation. Using a SIMPLE IRA, employers must match employee deferrals but the IRS limits SIMPLE IRA contributions to $13,000 per year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.