Loading

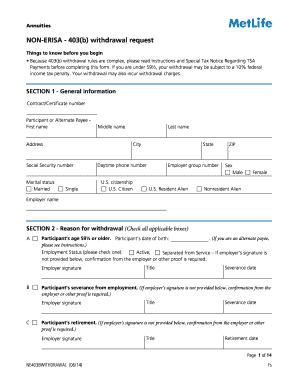

Get Non-erisa - 403(b) Withdrawal Request Form Metropolitan Life Insurance Company Metlife Investors

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NON-ERISA - 403(b) Withdrawal Request Form Metropolitan Life Insurance Company MetLife Investors online

Filling out the NON-ERISA - 403(b) Withdrawal Request Form from Metropolitan Life Insurance Company is a crucial step in managing your retirement funds. This guide will provide clear, step-by-step instructions to help you successfully complete the form online, ensuring that you understand each section and field.

Follow the steps to complete your withdrawal request form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Complete Section 1 - General Information. Fill in your Contract/Certificate number, First name, Middle name, Last name, Social Security number, address, city, state, ZIP, daytime phone number, and marital status. Ensure all details are entered accurately.

- In Section 2 - Reason for Withdrawal, check all applicable boxes to indicate the reason for your withdrawal (e.g., age, severance from employment, etc.). Ensure to provide supporting details, such as employer signatures if required.

- Move to Section 3 - Amount and Source of Withdrawal. Indicate whether you wish to withdraw your entire account balance or make a partial withdrawal. Specify the amount clearly and indicate how you would like it allocated across your investment options.

- In Section 4, if applicable, indicate any required minimum distribution instructions for rollovers or transfers. Check if you are enrolled in MetLife’s Minimum Distribution Service, and provide required amounts.

- Complete Section 5 regarding any outstanding loans. Indicate whether you are providing payment for them or want the loan treated as a distribution. If paying off a loan, include a certified check.

- Section 6 - Payment Instructions allows you to choose how you want to receive your funds, either via an electronic funds transfer (EFT) or a check. If opting for EFT, attach a voided check.

- Sections 7, 8, and 9 outline federal and state income tax withholding instructions. Select your preferences carefully, as these will affect your net distribution.

- In Section 10, you will need to provide your signature, affirming the accuracy of your information. Include the required date and any additional names as necessary.

- Submit your completed form via mail or fax, as indicated in the submission instructions provided at the end of the form.

Complete your withdrawal request form online today to manage your retirement funds efficiently.

Distributions from your before-tax 403(b) are considered ordinary income and are subject to federal and state income tax. Taxable distributions may also be subject to early withdrawal penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.