Loading

Get D-40b Nonresident Request For Refund - Otr - The District Of Columbia - Otr Cfo Dc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D-40B Nonresident Request For Refund - Otr - The District Of Columbia - Otr Cfo Dc online

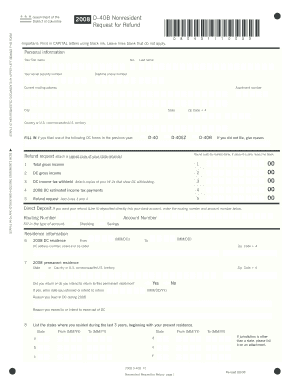

The D-40B Nonresident Request For Refund is an essential form for individuals who are seeking a refund of the District of Columbia income tax withheld. This guide will help you navigate through each section of the form, ensuring that you can complete it accurately and efficiently online.

Follow the steps to fill out your D-40B form with ease.

- Click the ‘Get Form’ button to access the D-40B Nonresident Request For Refund form and open it in the appropriate online editor.

- Begin by providing your personal information in the designated fields. Enter your first name, middle initial, last name, and social security number. Additionally, include your daytime phone number and complete your current mailing address, including apartment number, city, state, and zip code.

- In section D-40, if you filed a DC tax form in the previous year, select the applicable form from D-40EZ, D-40B, or the refund request to ensure proper processing.

- Report your total gross income and DC gross income in the respective fields, rounding cents to the nearest dollar. If the amount is zero, leave the line blank.

- Attach copies of your W-2 forms showing DC tax withheld. Complete the field for the total DC income tax withheld and the amount of DC estimated income tax payments made.

- Calculate your refund request by adding the amounts from the prior line items, and input the result in the refund request box. If you wish to receive your refund via direct deposit, provide your routing and account numbers.

- Fill out your residence information, indicating the period you lived in DC and providing your DC address and state of permanent residence. You will also need to confirm whether you are returning to your permanent residence.

- Complete the additional fields related to your voting information, military service if applicable, current and previous employment details, and any DC real property you own.

- Sign the form at the designated signature line to declare that all information is accurate to the best of your knowledge. Enter the date of your signature.

- Once all sections are completed, review your form for accuracy. Save changes, download a copy for your records, and print the form for mailing.

Complete your D-40B form online today for a smooth refund experience.

Nonresidents are non-taxable in DC. Nonresidents who erroneously had DC income tax withheld or made DC estimated tax payments may file Form D-40B to request a refund. Form D-40, Individual Income Tax Return. Use for resident and part-year resident returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.