Loading

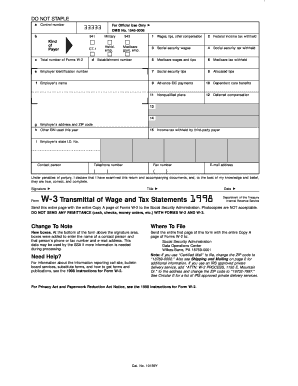

Get Form W-3 Transmittal Of Wage And Tax Statements - Internal ... - Irs Treas

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-3 Transmittal Of Wage And Tax Statements online

The Form W-3 serves as a transmittal for submitting Forms W-2 to the Social Security Administration. This guide provides clear steps and instructions to ensure that users can accurately complete and file this form online, helping employers fulfill their reporting obligations effectively.

Follow the steps to accurately complete the Form W-3 online.

- Press the ‘Get Form’ button to access the Form W-3 and open it in an online editor for filling out.

- Fill out Box a for the control number if applicable; this box is optional and can be used for your own tracking purposes.

- In Box b, select the appropriate type of payer by marking the corresponding checkbox. You may choose from options such as 941 for employers filing quarterly returns, Military for military employers, or others as applicable.

- Enter the total number of Forms W-2 you are transmitting in Box c.

- Box d allows you to enter your establishment number if desired; this is used to identify different business locations.

- In Box e, input your Employer Identification Number (EIN), ensuring it's in the correct format (00-0000000), and matches the EIN on your Forms W-2.

- Provide the employer’s name in Box f, ensuring it matches the one on your Forms W-2.

- For Box g, enter the employer's address and ZIP code, and correct any details if using a label.

- If you used a different EIN during the year, indicate it in Box h.

- Fill out Box i with the Employer’s state I.D. number if relevant.

- Complete Boxes 1 through 10 with the respective totals from Forms W-2.

- Submit your contact information, including the name, telephone, fax number, and e-mail address, in the provided fields.

- Once all sections are completed, make sure to review the information for accuracy before submitting.

- After ensuring everything is correct, you can save changes, download the form, print a copy, or share it as needed.

Ensure timely submission by completing your Form W-3 online today.

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.