Loading

Get Hmda Data Collection Worksheet 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hmda Data Collection Worksheet 2019 online

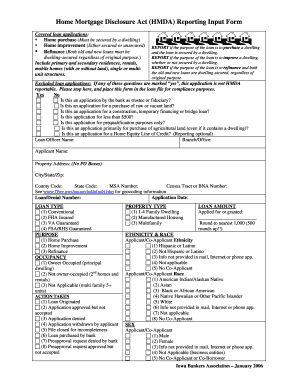

The Home Mortgage Disclosure Act (HMDA) Data Collection Worksheet is essential for reporting information about mortgage applications. This guide provides clear, step-by-step instructions for effectively completing the HMDA Data Collection Worksheet 2019 online.

Follow the steps to complete the HMDA Data Collection Worksheet accurately.

- To begin, click the ‘Get Form’ button to access the Hmda Data Collection Worksheet 2019. This will open the form in your editing interface.

- Indicate if the loan is for a covered purpose, such as home purchase, home improvement, or refinance. Ensure the loan is secured by a dwelling for it to be reportable under HMDA.

- Answer the exclusion questions. If any questions regarding excluded loan applications are marked ‘yes,’ stop completing the form and retain it in the loan file for compliance records.

- Fill in the loan officer's name, their branch or office, and the applicant's name. Make sure not to use a P.O. Box for the property address.

- Provide detailed information about the property, including the address, city, state, zip code, county code, state code, and MSA number. Utilize www.ffiec.gov/geocode/default.htm for geocoding information.

- Enter the application date and the loan or denial number. Specify the loan type, choosing from options such as conventional, FHA insured, VA guaranteed, or FSA/RHS guaranteed.

- Identify the purpose of the loan by selecting the appropriate option - either home purchase, home improvement, or refinance.

- Designate the occupancy status: owner-occupied, not owner-occupied, or not applicable for multifamily units.

- Select the action taken regarding the loan, such as originated, application approved, application denied, or closed for incompleteness.

- Classify the property type, indicating whether it is a 1-4 family dwelling, manufactured housing, or multifamily.

- Enter the loan amount applied for or granted, rounding to the nearest thousand.

- Complete the sections for ethnicity, race, and sex of the applicant or co-applicant. Provide accurate selections based on the options given.

- If applicable, specify the pre-approval status and provide gross income details relied upon for the credit decision, rounding as instructed.

- Document reasons for denial if applicable, selecting from the provided options.

- Complete the rate spread information for applicable loans and specify the type of purchaser if relevant.

- After completing all sections of the form, review for accuracy, then save changes, download the form, print it, or share as required.

Begin filling out your Hmda Data Collection Worksheet 2019 online today for efficient and compliant reporting.

Related links form

Table 1 lists all 110 HMDA data fields and their corresponding HMDA data points.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.