Loading

Get Hab Emp Rec

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hab Emp Rec online

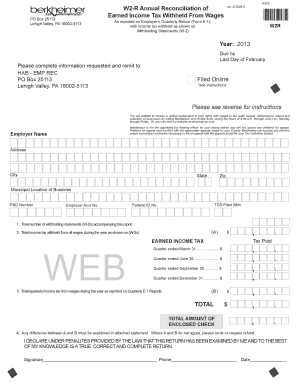

The Hab Emp Rec form is essential for businesses to report earned income tax withheld from employees. This guide provides step-by-step instructions on completing the form online to ensure that you meet your filing requirements accurately and efficiently.

Follow the steps to complete the Hab Emp Rec form online.

- Use the ‘Get Form’ button to access the form and open it in your desired editing interface.

- Fill in the employer's information, including the employer's name, address, city, state, zip code, and Federal ID number.

- Indicate the municipal location of the business and the associated PSD number.

- Enter the total number of W-2 withholding statements accompanying the report in the appropriate field.

- Provide the total income tax withheld from all wages during the year as shown on the W-2 statements, breaking it down by quarter.

- Accurately report the total quarterly income tax from wages as reflected in the Quarterly E-1 Reports.

- Include any explanation for discrepancies between the total reported in step 4 and 5, if applicable.

- Sign the form, include your phone number, and date it to confirm the accuracy of the information provided.

- Save your changes, and choose to download, print, or share the completed form as needed.

Complete your Hab Emp Rec form online today to ensure timely compliance with income tax regulations.

The Annual Withholding Reconciliation Statement (REV-1667) along with an individual Wage and Tax Statement/Information Statement (W-2/1099) for each employee/distribution recipient must be submitted annually on or before Jan. 31 following the year in which wages were paid or distributions occurred.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.