Loading

Get Exemption For Persons With Disabilities - Department Of Taxation...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Exemption For Persons With Disabilities - Department Of Taxation online

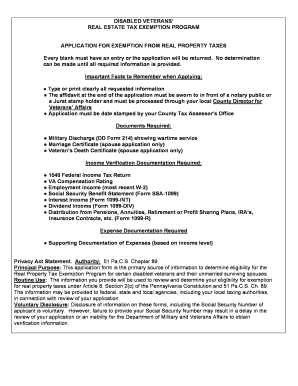

Filling out the Exemption For Persons With Disabilities form is an important step for individuals seeking relief from property taxes. This guide will provide clear and concise instructions to help users navigate the application process online, ensuring all necessary information is accurately provided.

Follow the steps to complete your application effectively.

- Press the ‘Get Form’ button to access the exemption form and open it in your browser or editor of choice.

- Begin by specifying whether you are applying as a veteran or a surviving spouse of a qualified veteran. Ensure that you complete all personal information requested in the relevant sections.

- In Section A, fill out all the required details for the veteran. In Section B, complete the information for the spouse, if applicable.

- In Section C, review your veteran's disability rating and exemptions. Check all relevant blocks that apply to your situation.

- For Section D, list all dependent members residing in your household, including their relationship to the veteran and date of birth.

- In Section E, indicate the property information by checking the appropriate blocks for ownership and usage.

- Fill out Section F with your gross income before any deductions and include all necessary documentation to verify your income.

- Complete Section G only if your annual income exceeds $81,340, attaching all required financial documents as proof of expenses.

- In Section H, ensure that the affidavit is signed and sworn to before a notary public or a Jurat stamp holder.

- Finally, after reviewing all entries for accuracy, save your changes. You may choose to download, print, or share the completed form as required.

Take action now and fill out your exemption form online to ensure you receive the benefits you deserve.

The disabled veteran must be a Texas resident and must choose one property to receive the exemption. In Texas, veterans with a disability rating of: 100% are exempt from all property taxes. 70 to 100% receive a $12,000 property tax exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.