Loading

Get W 7 Coa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-7 COA online

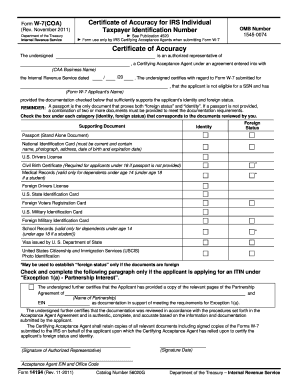

The W-7 COA, or Certificate of Accuracy, is a crucial document prepared by IRS Certifying Acceptance Agents as part of the Individual Taxpayer Identification Number application process. This guide provides you with clear, step-by-step instructions to effectively fill out the form online, ensuring accuracy and compliance throughout the process.

Follow the steps to complete the W-7 COA form.

- Press the ‘Get Form’ button to access the W-7 COA form and open it in your online document editor.

- Begin by entering the name of the designated authorized representative who is completing the Certificate of Accuracy. This person must be officially designated by the Certifying Acceptance Agent (CAA).

- Input the legal name of your business as it appears on your IRS Acceptance Agent Agreement. Ensure this matches the name on Form 13551.

- Provide the Employer Identification Number (EIN) assigned to your business, along with the office code specific to your application.

- Fill in the date when the Acceptance Agent Agreement was approved. Refer to your agreement if you do not have this information easily available.

- Clearly state the name of the ITIN applicant, which is the individual for whom the W-7 is being submitted.

- Review the supporting documentation provided by the applicant. Check the appropriate boxes under 'Identity' and 'Foreign Status' to indicate which documents were reviewed. Remember, a passport serves both purposes; otherwise, you must select multiple documents to satisfy the criteria.

- If applicable, complete the section detailing the Partnership Agreement for applicants applying under Exception 1(a). Include the name of the partnership and its EIN.

- Affirm that all documentation reviewed is authentic, complete, and accurate. This certification must reflect your knowledge and review process as the Certifying Acceptance Agent.

- Finally, add your signature as the authorized representative, along with the date of signing. Ensure that all required fields are completed before proceeding.

- Once all steps are complete, save your changes, and consider downloading, printing, or sharing the form as needed.

Start completing your W-7 COA form online today to ensure adherence to IRS requirements.

In order to retrieve a lost ITIN (that is Individual Taxpayer Identification Number), you will need to call the IRS ITIN Hotline at 1-800-908-9982. You can answer a series of questions to verify your identity and the IRS will provide you the number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.