Loading

Get Certificate Of Tax Collected At Source Under Section 206c(5)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate Of Tax Collected At Source Under Section 206C(5) online

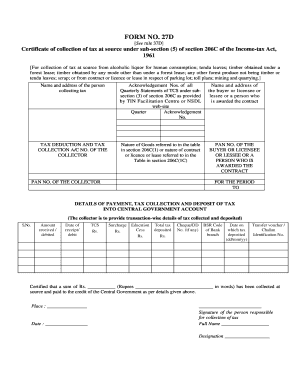

The Certificate Of Tax Collected At Source Under Section 206C(5) is an important document required for reporting tax collection from specific transactions. This guide provides clear, step-by-step instructions to help you fill out the form correctly online.

Follow the steps to accurately complete the form.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the first section, enter the name and address of the person collecting tax. Ensure this information is accurate to avoid any complications.

- Next, gather the acknowledgement numbers of all Quarterly Statements of TCS provided by the TIN Facilitation Centre or NSDL website, and fill them in the specified fields.

- Provide the name and address of the buyer, licensee, lessee, or contract recipient in the designated area.

- Enter the Tax Deduction and Tax Collection Account Number of the collector to identify the account from which the tax is collected.

- Specify the nature of goods or contract in accordance with section 206C(1), ensuring that all required details are accurately described.

- Fill in the Permanent Account Number (PAN) of the buyer or licensee or lessee, ensuring it matches the records for accurate tax collection.

- Include the PAN number of the collector in the respective field.

- Record the period of tax collection by indicating the start and end dates.

- In the details section for payment, tax collection, and deposit of tax into the Central Government account, provide transaction-wise details including the amount received, date of receipt, tax collected, and all other relevant financial details.

- Certify the collected tax amount, filling in the total sum collected and written amount in words, as this is a necessary statement for validation.

- Complete the form by signing it with your full name, designation, and provide the date and place of the signature.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed form as needed.

Get started and ensure your documents are filed online accurately today.

A Seller of Goods is liable to collect TCS from Buyer on Sale of any goods; Turnover of seller is more than 10 Crores in preceding financial year; TCS to be collected if the Value/Aggregate Valuereceived for Goods from a buyer is more than 50 Lakhs in a financial year; ... Rate of TCS is 0.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.