Loading

Get Texas Home Equity Loan Closing Instructions Addendum

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Home Equity Loan Closing Instructions Addendum online

Filling out the Texas Home Equity Loan Closing Instructions Addendum is a crucial step in ensuring a smooth and compliant closing process. This guide provides clear, step-by-step instructions for completing the addendum online, allowing users to navigate the process with confidence.

Follow the steps to successfully complete the addendum.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

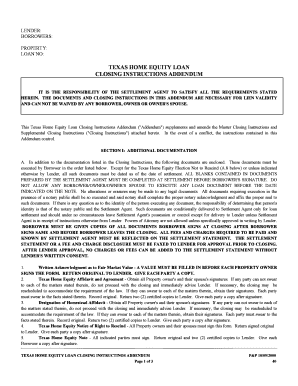

- Begin by entering the lender's name in the designated field. Ensure that this is accurate as it is key for identification.

- Fill in the borrower's names under the 'Borrowers' section. This should include all individuals involved in the loan agreement.

- Specify the property details in the appropriate section. Include the full address and any property identifying information requested.

- Input the loan number accurately in the given field. This is essential for tracking and processing the loan.

- Carefully review the 'Section I: Additional Documentation' which outlines specific documents required for execution. Make sure to note which documents must be signed by the borrowers.

- Complete each document sequentially as outlined. Certain forms, such as the Texas Home Equity Affidavit and Agreement, require all parties to sign.

- Ensure that all signatures are obtained in accordance with the law, particularly for documents requiring notarization.

- Collect all required fees and disclosures, and confirm that these are accurately reflected in the settlement statement, which also needs to be approved by the lender before proceeding.

- After completing the form, you can save any changes, download it for your records, print a physical copy, or share it with necessary parties as needed.

Complete your Texas Home Equity Loan Closing Instructions Addendum online today for a seamless closing process.

8) Question: Can a borrower assume a Texas home equity loan, if the lender approves the new borrower and releases the previous borrower of liability? Answer: Not per the Fannie/Freddie docs, but not prohibited by law if no longer that borrower's homestead.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.