Loading

Get Loan Summary Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Summary Sheet online

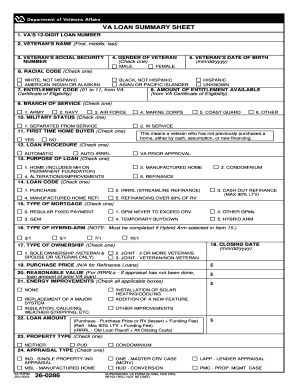

Filling out the Loan Summary Sheet is a crucial step in securing your VA loan. This guide provides clear and precise instructions to help you complete the form online with confidence.

Follow the steps to successfully fill out your Loan Summary Sheet

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the VA’s 12-digit loan number at the top of the form as your unique identifier for the loan.

- Fill in the veteran’s name, including first, middle, and last names. This should match the details on official identification.

- Input the veteran’s social security number. Ensure this is accurate, as it is vital for identity verification.

- Select the gender of the veteran by checking the appropriate box.

- Provide the veteran’s date of birth in the format mm/dd/yyyy.

- Choose the racial code by checking one of the available options.

- Enter the entitlement code, which can be found on the VA Certificate of Eligibility.

- Indicate the amount of entitlement available from the same certificate.

- Select the branch of service by checking the appropriate option corresponding to the veteran's service.

- Specify the military status by checking either 'Separated from service' or 'In service'.

- Indicate if this is the first time the veteran is buying a home by checking 'Yes' or 'No'.

- Select the loan procedure by checking one of the given options.

- Identify the purpose of the loan by marking the appropriate choice.

- Select the loan code that corresponds to the type of loan being applied for.

- Choose the type of mortgage by checking one of the options provided.

- If applicable, complete the type of hybrid-ARM selected previously.

- Fill in the closing date for the loan in mm/dd/yyyy format.

- Select the type of ownership by checking the appropriate box.

- If purchasing a property, enter the purchase price. This field is not applicable for refinance loans.

- Enter the reasonable value for IRRRLs or any prior loan amounts as necessary.

- Indicate any energy improvements by checking the applicable boxes.

- Specify the loan amount, based on the calculations relevant to the type of loan.

- Select the property type that applies to your loan by checking the relevant option.

- Indicate the appraisal type by checking the box that fits your situation.

- Select the type of structure by marking one of the available choices.

- Determine the property designation and check the appropriate box.

- Indicate the number of units by choosing the applicable option.

- Choose the manufactured home category if relevant by marking the correct box.

- Provide the property address, ensuring accuracy for location verification.

- Fill in the city name related to the property's location.

- Input the state where the property is located.

- Enter the zip code for the property address.

- Fill out the county information based on the property's location.

- Enter the lender VA ID number for identification purposes.

- If applicable, input the agent VA ID number.

- Enter the lender loan number associated with the transaction.

- Input the lender SAR ID number if required for specific loan applications.

- Fill in the gross living area of the property in square feet.

- Indicate the age of the property in years.

- Provide the date when the SAR issued notification of value.

- Enter the total room count in the property.

- Fill in the number of baths available in the property.

- Indicate the number of bedrooms in the property.

- If processed under LAPP, indicate whether the appraiser’s original value estimate changed.

- Provide income information if applicable, noting if the loan was processed under VA recognized automated underwriting system.

- Enter the credit score based on the veteran's information.

- Fill in the liquid assets information.

- Provide total monthly gross income by adding specified items from related forms.

- Enter the residual income.

- Fill in the residual income guideline as required.

- Indicate the debt-to-income ratio and include any necessary justification if it exceeds limits.

- Specify whether spouse income has been considered for the loan application.

- If spouse's income is considered, provide the amount here.

- Indicate any discount points charged as a percentage or dollar amount.

- Enter discount points paid by the veteran as a percentage or dollar amount.

- Fill in the term of the loan in months.

- Provide the interest rate for the loan.

- Indicate if the funding fee exemption applies to the loan.

- Enter the paid in full VA loan number if applicable.

- Indicate the original loan amount.

- Provide the original interest rate in percentage.

- Use this space for any additional remarks or notes relevant to your application.

- Review all filled-out sections for accuracy and completeness before submitting your form.

Complete your Loan Summary Sheet online today to ensure a smooth loan application process.

0:14 6:17 VA Loan Analysis Form Overview - YouTube YouTube Start of suggested clip End of suggested clip In order to qualify for a VA loan the borrower. Must have a minimum amount of residual or leftoverMoreIn order to qualify for a VA loan the borrower. Must have a minimum amount of residual or leftover income after subtracting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.