Loading

Get Sales And Use Tax Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

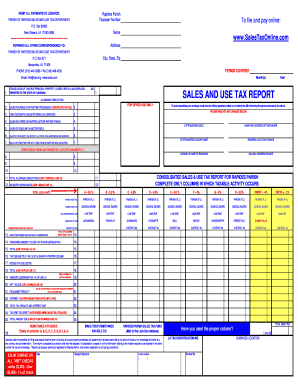

How to fill out the SALES AND USE TAX REPORT online

Filing the sales and use tax report online can streamline the process and help ensure compliance with tax regulations. This guide provides clear, step-by-step instructions on how to accurately complete each section of the SALES AND USE TAX REPORT.

Follow the steps to successfully complete your report

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your taxpayer number at the top of the form to uniquely identify your account.

- Specify the period covered by the report by entering the month(s) and year.

- Detail any allowable deductions on the subsequent lines. This includes items such as sales for resale or further processing, cash discounts, sales returns, and allowances. Be sure to follow the provided categories.

- Once you have calculated the total allowable deductions, subtract this amount from your gross sales to determine your adjusted gross sales.

- Enter any excess tax collected, if applicable. This can impact your final tax calculation.

- Finally, review the completed form for accuracy and completeness. Once satisfied, you can save, download, or print the report for your records. After that, ensure it is submitted to the appropriate address provided on the form.

Ensure your tax compliance by completing the SALES AND USE TAX REPORT online today.

For example, you may have a local tax or an additional tax on specific items. Convert the percentage to a decimal -- so 7% becomes 0.07. Finally, divide the gross price by the sales tax rate plus one. This gives you the net sales price.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.