Loading

Get (revised 7/12) - Kansasjudicialcouncil

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the (Revised 7/12) - Kansasjudicialcouncil online

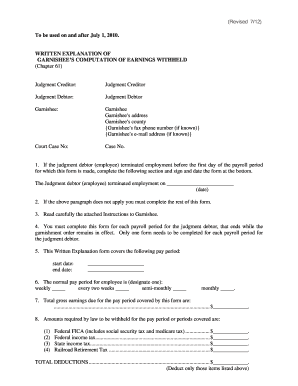

The (Revised 7/12) - Kansasjudicialcouncil is a crucial document used in the garnishment process to outline the computation of earnings withheld. This guide provides clear and step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete the form correctly.

- Click 'Get Form' button to access the document and open it in the editor.

- Begin by entering the names of the judgment creditor and the judgment debtor in the designated fields. Ensure accuracy to avoid future issues.

- Input the garnishee’s information, including their address, county, fax number, and email address if known.

- Fill in the court case number relevant to this garnishment. This ensures that your filing is linked to the correct legal matter.

- If the judgment debtor has terminated employment before the payroll period in question, fill out the termination date and proceed to sign and date the form at the bottom.

- If the termination does not apply, continue filling out the form by indicating the pay period start and end dates.

- Select the normal pay period for the employee by marking the appropriate option: weekly, every two weeks, semi-monthly, or monthly.

- Enter the total gross earnings due for the specified pay period in the respective field.

- Detail the mandatory withholdings for federal FICA, federal income tax, state income tax, and railroad retirement tax, filling in the required amounts.

- Calculate the total deductions by summing the amounts withheld and inputting this total in the designated area.

- Determine the disposable earnings for that pay period by subtracting total deductions from gross earnings.

- If there are additional amounts to subtract based on income withholding orders or priority liens, input those specific amounts in the specified sections.

- Calculate the amount available to be paid to the employee after all deductions have been considered.

- Fill in the administrative fee that can be retained from the amount above as stated in the instructions.

- Identify the judgment creditors you will pay and fill in their details, including the case number, name, address, and amount.

- Conclude by signing and dating the form to affirm that the information provided is accurate.

- Once completed, retain the original form with your payroll records and consider making copies if others request them.

Complete your documents online for a streamlined process.

(See Select a Field.) Click Group (Field menu). A bounding frame appears around the grouped fields. (You can also right-click and select Group from the shortcut menu.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.