Loading

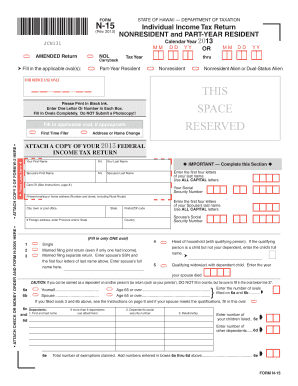

Get Form N-15, Rev 2013, State Of Hawaii Non-resident ... - Hawaii.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form N-15, Rev 2013, State Of Hawaii Non-Resident online

Filling out the Form N-15, Rev 2013, is necessary for non-residents and part-year residents of Hawaii to report their income and calculate their tax liability. This guide provides clear, step-by-step instructions to assist users in correctly completing the form online.

Follow the steps to successfully fill out the form.

- Press the ‘Get Form’ button to retrieve the form and display it in the editor.

- Enter your personal information in the designated fields. Start with your first name, middle initial, and last name as well as your Social Security number. If applicable, provide your spouse's information in the same manner.

- Indicate your filing status by filling in the appropriate oval. Choose from options such as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- List your dependents by filling out their first and last names, Social Security numbers, and their relationship to you.

- Complete the Income section by accurately entering all relevant income sources on the provided lines, from wages to other income types.

- Include any adjustments to your income, such as student loan interest deductions, IRA deductions, and any other applicable deductions.

- Calculate your adjusted gross income by subtracting total adjustments from your total income.

- Fill out the deductions section, entering either the standard deduction or your itemized deductions, as appropriate.

- Complete the tax liability section by entering your taxable income and calculating the applicable tax based on the instructions provided.

- Finally, review your entries for accuracy, sign the form, and submit it. Ensure you keep a copy for your records. You can save changes, download, print, or share the form as needed.

Complete your Form N-15 online now to ensure accurate tax filing.

Form G-49 - All filers must file an annual return and reconciliation (Form G-49) after the close of the taxable year. Form G-49 is a summary of your activity for the entire year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.