Loading

Get Form G6 - Hawaii.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form G6 - Hawaii.gov online

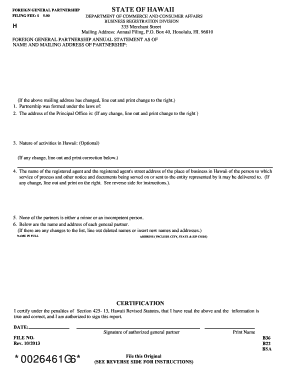

Filling out the Form G6 is an essential step for foreign general partnerships operating in Hawaii. This guide will walk you through the process, ensuring that you complete each section accurately and effectively.

Follow the steps to fill out the Form G6 correctly.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Enter the name and mailing address of the partnership at the top of the form. If this address has changed, please strike through the old address and write the new one clearly next to it.

- In the next section, state the state or country under which the partnership was formed. Be sure to type this information clearly.

- Provide the address of the principal office of the partnership. If there are any updates to this address, indicate the changes by crossing out the old address and writing the new one next to it.

- Optionally, describe the nature of activities the partnership engages in within Hawaii. If the partnership was inactive during the period, you may write 'Inactive.'

- List the name and address of the registered agent for the partnership. This agent must be a resident of Hawaii or an entity authorized to conduct business in the state. If there are any changes among the agents, please strike through the old information and provide the new details.

- Confirm that none of the partners is a minor or a person deemed incompetent. This information is required.

- Input the names and addresses of each general partner. Make sure that the information is accurate and comprehensive. If any changes occur, strike through the old entries and insert the new information.

- Review all information provided for accuracy. The authorized general partner must sign the form in black ink and include the date of signing.

- After completing the form, save any changes made. You may download it for your records, print a copy for submission, or share it accordingly.

Complete your Form G6 online today to ensure compliance with Hawaii regulations.

In addition to form G-45, Hawaii General Excise Taxpayers must complete form G-49 (Annual Return & Reconciliation of General Excise / Use Tax Return) once a year. ... Form G49 is designed to give you credit for all of the taxes you paid, so if your gross income number is smaller than as expected, you may even get a refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.