Loading

Get Bankruptcy Forms - Stop The Power - Stopthepower

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bankruptcy Forms - Stop The Power - Stopthepower online

Filling out bankruptcy forms can seem daunting, but with a clear guide, you can navigate the process with confidence. This comprehensive guide will walk you through the Bankruptcy Forms - Stop The Power - Stopthepower, ensuring you complete each section accurately and efficiently.

Follow the steps to successfully complete the bankruptcy forms.

- Press the ‘Get Form’ button to access the document and open it for editing. This is your starting point to ensure you have the latest version of the bankruptcy forms.

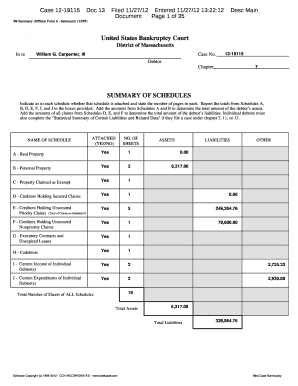

- Begin with the summary of schedules section. Indicate if each schedule is attached by marking 'Yes' or 'No' and specify the number of pages for each. This helps create a comprehensive overview of your financial situation.

- Complete Schedule A for real property. List all real estate owned and provide details about your legal interest and any secured claims associated with the property.

- Fill out Schedule B, which addresses personal property. Here, you will disclose all types of personal assets, including cash, vehicles, and other valuables. Ensure to provide accurate valuations.

- Move to Schedule C to claim exemptions. Identify the property you wish to exempt by referencing the appropriate laws and providing the current value.

- In Schedule D, list all secured creditors. Provide the name, address, nature of the lien, and the amount owed to each creditor.

- Complete Schedule E, detailing unsecured priority claims. Provide the necessary information about any priority debts you have.

- Next, complete Schedule F for unsecured nonpriority claims. This is where to list any debts that do not have priority status.

- In Schedule G, document any executory contracts and unexpired leases. Outline your interests and relationships to the parties involved.

- Finally, fill out Schedule H for codebtors and Schedules I and J, which detail your current income and expenditure. These sections help paint a full picture of your financial status.

- Review all completed sections for accuracy. This is an essential step before finalizing your form.

- Once everything is filled out, you can choose to save your changes, download, print, or share the form as needed. Make sure to keep a copy for your records.

Complete your bankruptcy forms online efficiently and accurately, empowering your financial future.

Chapter 7 provides relief to debtors regardless of the amount of debts owed or whether a debtor is solvent or insolvent. A Chapter 7 Trustee is appointed to convert the debtor's assets into cash for distribution among creditors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.