Loading

Get Form 53 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 53 1 online

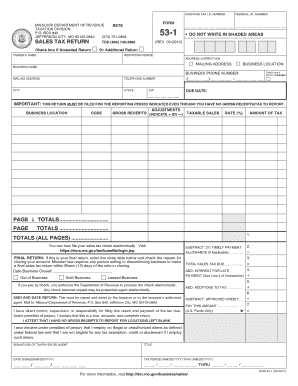

Filling out the Form 53 1 online can simplify your sales tax return process. This guide provides step-by-step instructions to help you accurately complete the form, ensuring compliance with Missouri tax regulations.

Follow the steps to complete the Form 53 1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Missouri Tax I.D. number in the designated field at the top of the form. This identifies your business for tax purposes.

- Fill in the owner's name and business name. Ensure that the information is accurate and matches what is registered with the state.

- Provide the business location and mailing address. If there is a change in your phone number, check the corresponding box.

- Input the reporting period during which you are filing the tax return. This helps in determining the time frame for the tax obligations.

- Complete the gross receipts section for each business location. This should include all sales made during the reporting period.

- Detail any adjustments or nontaxable receipts in the adjustments section, indicating each one as a plus or minus.

- Record the taxable sales and the corresponding tax rate for each business location. Make sure to access the correct rate from the Missouri tax website if needed.

- Calculate the total sales tax due by summing up the amounts from the previous sections.

- If applicable, subtract any approved credits and include them in the relevant field.

- Sign and date the return at the bottom of the form. This must be done by you or your authorized agent.

- Review all the information filled out in the form for accuracy before finalizing it.

- Once completed, save the changes, download, print, or share the form as needed to ensure it is submitted correctly.

Complete your sales tax return online today to streamline your filing process.

The gain on the sale of a personal item is taxable. You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital AssetsPDF, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and LossesPDF.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.