Loading

Get Dr 0104ep

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 0104ep online

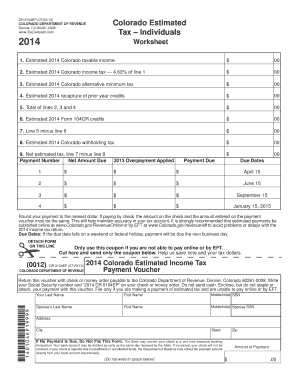

Filling out the Dr 0104ep form is an essential step for individuals looking to estimate their income tax obligations in Colorado. This guide provides a clear, step-by-step process to help you complete the form accurately and efficiently.

Follow the steps to complete the Dr 0104ep online.

- Press the ‘Get Form’ button to access the Dr 0104ep form and open it in your preferred online editor.

- Input your estimated taxable income for the year in line 1 of the form.

- Calculate your estimated income tax by multiplying the amount from line 1 by 4.63%, and enter the result in line 2.

- If applicable, calculate your estimated alternative minimum tax and enter that amount in line 3.

- Include any recapture of prior year credits in line 4.

- Sum the amounts from lines 2, 3, and 4, and write the total in line 5.

- If you have credits from the 104CR form, enter that amount in line 6.

- Subtract the amount in line 6 from line 5 and write the result in line 7 to determine your net estimated tax.

- Enter any withholding tax you have in line 8.

- Subtract line 8 from line 7 for your net estimated tax and payment due in line 9.

- Fill out the payment section, including the amounts, and ensure all details are accurate.

- Once you have completed all sections, review the form for accuracy, then save your changes or download the form for printing or sharing.

Complete your Dr 0104ep online today for accurate tax estimation!

To request a form be sent to you via email or USPS standard mail, please email your request to DOR_TaxpayerService@state.co.us. Please be sure to specify whether you would like a digital copy or mailed copy of the form. Please allow 4-6 weeks to receive the requested form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.