Loading

Get Dr 1366

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 1366 online

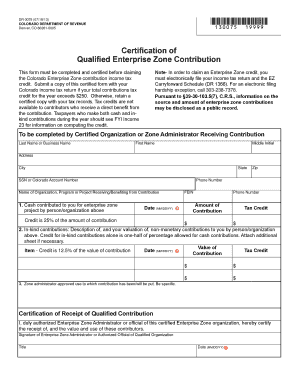

Filling out the Dr 1366 form is an essential step for claiming a Colorado Enterprise Zone contribution income tax credit. This guide will provide you with clear and concise instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Dr 1366 form online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Locate the section for Certified Organization or Zone Administrator. Enter the last name or business name of the individual or organization receiving the contribution in the designated field.

- Fill in the first name and middle initial of the individual associated with the contribution. Provide their complete address, including city, state, and zip code.

- Input the social security number or Colorado account number for the individual or organization in the respective field.

- Record the phone number associated with the contributor. Make sure to format it correctly, including area code.

- Specify the name of the organization, program, or project that is receiving or benefiting from the contribution.

- Describe the cash contributions provided to the enterprise zone project by the individual or organization, and record the amount contributed.

- Enter the date of the cash contribution in the MM/DD/YY format, and calculate the tax credit, which is 25% of the cash contribution amount.

- For in-kind contributions, describe the type of non-monetary contributions received and assign a valuation to each. Record the total value, along with the date and the corresponding tax credit, which is 12.5% of the value.

- Detail the use of the contribution as approved by the zone administrator. Be specific in your description.

- The authorized enterprise zone administrator or official must certify the receipt of qualified contributions by signing in the provided section and entering their title and date.

- After completing all necessary sections, save your changes. Download, print, or share the completed form as required.

Complete your Dr 1366 form online today and ensure your enterprise zone contribution is properly documented!

Eligibility Requirements: All full-year and part-year Colorado residents who qualify for the federal EITC are automatically eligible, and Colorado residents filing with Individual Taxpayer Identification Numbers (ITINs) qualify for the state EITC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.