Loading

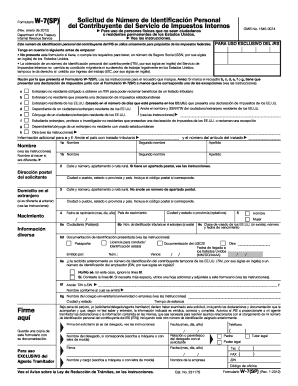

Get Form W-7 (sp) (rev. January 2012). Application For Irs Individual Taxpayer Identification Number

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-7 (SP) (Rev. January 2012). Application for IRS Individual Taxpayer Identification Number online

Filling out the Form W-7 (SP) is an essential step for individuals who need to apply for an IRS Individual Taxpayer Identification Number (ITIN). This guide will walk you through each section of the form with clear and concise instructions to ensure accurate completion.

Follow the steps to accurately complete your Form W-7 (SP)

- Press the ‘Get Form’ button to access the form and open it in your selected editor.

- Indicate the reason for your application by selecting one of the checkboxes labeled a through h. Refer to the instructions for specifics on each category.

- Enter your full name as it appears on your identification documents. Include your first name, middle name (if applicable), and last name.

- Provide your foreign address in detail, ensuring to include all necessary information such as street name and number, city, state or province, country, and postal code.

- Fill out your date of birth in the format of month, day, and year, and indicate your country of birth.

- Select your gender and provide the necessary information regarding your nationality and any Tax Identification Numbers (TIN) or Employer Identification Numbers (EIN) you may have.

- Complete the section detailing any previous TIN or EIN received, if applicable. If you have received one before, complete the additional fields provided.

- Attach any required documentation for identification, selecting from the options provided, such as a driver's license or passport.

- Sign the form in the designated area to certify that all information is true and complete, and include the date of signing.

- Once you have completed all sections, review for accuracy. You can save the form, download it, print it, or share it as needed.

Start filling out your Form W-7 (SP) online today to secure your Individual Taxpayer Identification Number.

Related links form

An Individual Taxpayer Identification Number (ITIN) is a United States tax processing number issued by the Internal Revenue Service (IRS). ... Regardless of immigration status, both resident and nonresident immigrants may have Federal tax return and payment responsibilities under the Internal Revenue Code.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.