Loading

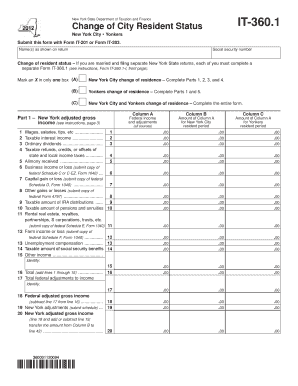

Get Form It-360.1:2012:change Of City Resident Status:it3601

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-360.1:2012:Change Of City Resident Status online

Filling out the Form IT-360.1 for a change of city resident status can seem daunting. This guide provides clear and supportive instructions on how to successfully complete the form online, ensuring you meet all necessary requirements.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your name(s) as shown on your tax return. Make sure the name(s) match the documentation you will submit.

- Indicate your change of resident status. Select only one box: (A) for a New York City change, (B) for a Yonkers change, or (C) for both. Ensure you complete the appropriate sections based on your selection.

- If you are claiming itemized deductions for New York City, complete Part 2. Otherwise, skip to Part 3 if claiming standard deductions.

- Part 4 requires you to calculate your New York City resident tax. Use the figures from previous parts to derive your taxable income and necessary taxes owed.

- Once all sections are complete, review your entries for accuracy. Save your changes, and choose to download, print, or share the completed form as needed.

Complete your Form IT-360.1 online today to ensure a smooth transition of your resident status.

If you changed your New York City or Yonkers resident status during the year, complete Form IT-360.1, Change of City Resident Status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.