Loading

Get Download Form W-3n-amended - Formupack

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Download Form W-3N-Amended - FormuPack online

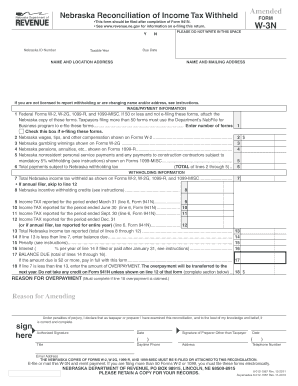

Filling out the Download Form W-3N-Amended - FormuPack online can seem daunting, but this guide will help you through each step. This form is essential for employers or payors reconciling income tax withheld in Nebraska.

Follow the steps to complete your form efficiently.

- Click the ‘Get Form’ button to download the document and open it for editing.

- Enter your Nebraska ID number in the designated field to identify your tax account.

- Specify the taxable year for which you are filing this amended reconciliation.

- Indicate whether this is an amended form by checking the appropriate box.

- Fill in your name and mailing address accurately, ensuring all details are correct.

- In the wage/payment information section, report the number of federal forms W-2, W-2G, 1099-R, and 1099-MISC you are submitting.

- Provide the total Nebraska wages, tips, and other compensation reported on the included federal forms.

- List any Nebraska gambling winnings and pensions or annuities, as applicable, shown on the respective forms.

- Calculate and report the total payments subject to Nebraska withholding tax by summing lines 2 through 5.

- Enter the total Nebraska income tax withheld as reflected on the federal forms.

- Fill in any Nebraska incentive withholding credits, if applicable, as outlined in the instructions.

- Report the income tax for each quarter as indicated, following the sequential lines from 9 to 12.

- Calculate the total Nebraska income tax reported, and enter this total.

- If applicable, indicate any balance due based on the reportable amounts.

- Document any penalties and interest if your submission is late, following the provided instructions.

- Complete the reason for overpayment if claiming one, and detail the rationale as required.

- Sign and date the form, ensuring you comply with the signature requirements whether you are the taxpayer or a preparer.

- After completing all sections, you can save your changes, download the form, print it, or share it as needed.

Complete your documents online today to ensure timely filing and compliance.

Every employer or payor withholding Nebraska income taxes from employees or payees must file a Nebraska Reconciliation of Income Tax Withheld, Form W-3N.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.