Loading

Get Form Sd W 4a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Sd W 4a online

Filling out the Form Sd W 4a is essential for accurately calculating your withholding allowances for state taxes. This guide will provide you with clear, step-by-step instructions on how to complete the form online, ensuring that you understand each section and field.

Follow the steps to complete the Form Sd W 4a online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

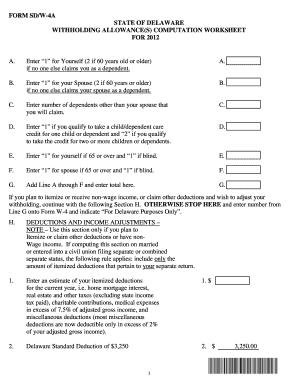

- In section A, enter '1' for yourself or '2' if you are 60 years old or older, provided that no one else claims you as a dependent. Write this number in the space provided.

- In section B, enter '1' for your spouse or '2' if they are 60 years or older, ensuring that no one claims them as a dependent. Record this number in the corresponding area.

- For section C, state the number of dependents other than your spouse that you will claim. Enter this number in the designated field.

- In section D, input '1' if you are eligible for a child/dependent care credit for one child or dependent, or '2' if you qualify for two or more. Capture this number in section D.

- For section E, enter '1' for yourself if you are 65 years or older or if you are blind. Fill this number in the provided box.

- In section F, follow the same instructions as section E for your spouse if applicable. Write this number in section F.

- Add the values from sections A through F and input the total in section G.

- If you plan to itemize deductions or have non-wage income, proceed to section H. If not, take the number from section G and enter it onto Form W-4, indicating 'For Delaware Purposes Only.'

- For Line 2, enter the Delaware standard deduction of $3,250.

- Calculate Line 3 by subtracting Line 2 from Line 1, ensuring it does not fall below zero, and record the result.

- In Line 4, enter the estimate of your subtraction adjustment to income for the current year.

- Add the results from Lines 3 and 4 in Line 5.

- Estimate your non-wage income for the current year and input this amount into Line 6.

- Calculate Line 7 by subtracting Line 6 from Line 5 and entering the outcome.

- In Line 8, divide the amount from Line 7 by 2,000 and input the whole number result.

- Refer to Line 9 to input the number from Line G above. Lastly, add Lines 8 and 9 in Line 10. If this sum is negative, follow the special instructions provided.

- Review all entries for accuracy and save any changes. You may choose to download, print, or share the completed form accordingly.

Complete your Form Sd W 4a online today to ensure proper withholding and compliance.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.