Loading

Get It40x

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It40x online

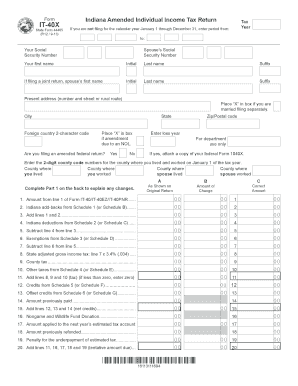

The It40x is the Indiana Amended Individual Income Tax Return, a necessary document for correcting a previously filed state tax return. This guide provides user-friendly instructions for completing the form online, ensuring a smooth filing process for users of all experience levels.

Follow the steps to complete the It40x form online:

- Click the ‘Get Form’ button to obtain the It40x document and open it in your preferred editor.

- Enter the tax year you are amending in the specified field.

- Input your Social Security number, followed by your spouse's Social Security number if applicable.

- Fill in your first name, initial, last name, and suffix, and do the same for your spouse if filing jointly.

- Provide your current address, including city, state, and zip code. If applicable, enter a foreign country code.

- Mark the appropriate boxes if you are married filing separately or if the amendment is due to a net operating loss.

- Indicate whether you are also filing an amended federal return by selecting 'Yes' or 'No'.

- Enter the county codes where you lived and worked, as well as where your spouse lived and worked on January 1 of the tax year.

- Complete Part 1 on the back of the form to explain any changes made, including amounts from your original return and the corrected amounts.

- Refer to the instructions for various lines on the form to accurately list Indiana add-backs, deductions, and credits.

- Enter any refund or amount due on the respective lines based on your calculations.

- Sign and date the form, ensuring both you and your spouse sign if filing jointly.

- Provide a daytime telephone number and an email address for communication purposes.

- Finally, save your changes, download the completed form, or share it as required.

Complete your It40x form online today and ensure your amended tax return is submitted accurately.

If you filed an amended return or we adjusted your account after it was processed, request a record of account transcript. If the transcript obtained doesn't appear to be correct or contains unfamiliar information due to possible identity theft, call us at 800-829-1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.