Loading

Get Alabama Department Of R Form-v Individualand C T D Fiduciary ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ALABAMA DEPARTMENT OF REVENUE FORM FDT-V online

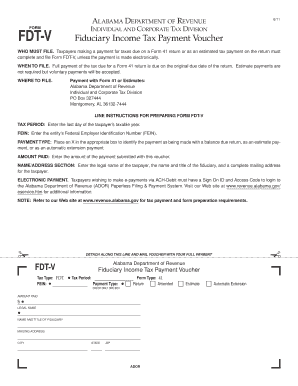

This guide provides clear instructions on how to complete the Alabama Department of Revenue Form FDT-V online. By following these steps, you can ensure that your fiduciary income tax payment voucher is filled out accurately and submitted properly.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Identify the tax period by entering the last day of the taxpayer’s taxable year in the designated field.

- Enter the Federal Employer Identification Number (FEIN) of the entity in the appropriate section.

- Select the payment type by placing an X in the box corresponding to whether the payment is for a balance due return, an estimate payment, or an automatic extension payment.

- Fill in the amount of the payment you are submitting with this voucher in the designated field.

- In the Name/Address section, provide the legal name of the taxpayer, the name and title of the fiduciary, and a complete mailing address.

- If choosing to make an electronic payment, ensure you have a Sign On ID and Access Code to log in to the Alabama Department of Revenue Paperless Filing & Payment System.

- Before printing, ensure that all data is accurately entered, as handwritten data is not permitted on the form.

- Use the PRINT FORM button to generate a 2D barcode, which will significantly enhance the processing of your return.

- Once you have reviewed the form, you can save your changes, download, print, or share the completed voucher as needed.

Complete your document online securely and efficiently.

Time Limitations In most cases, the department has three years from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due. A taxpayer also generally has three years to claim a refund of any tax overpaid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.