Loading

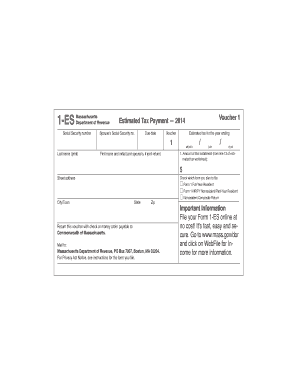

Get 1-es Department Of Revenue Estimated Tax Payment 2014 ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1-ES Department Of Revenue Estimated Tax Payment 2014 online

Filling out the 1-ES Department of Revenue Estimated Tax Payment form online is essential for ensuring your estimated taxes are filed accurately and timely. This guide provides clear instructions on how to successfully complete each section of the form.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your Social Security number in the designated field. Ensure this is accurate as it identifies your tax records.

- Next, enter your last name in the section provided. If you are filing jointly, include your partner's last name as well.

- Indicate your spouse’s Social Security number, if applicable. If you are not filing jointly, leave this section blank.

- Complete the due date field with the payment deadline for your estimated taxes.

- Provide your first name and initial in the appropriate fields. If you are filing jointly, include your partner's first name and initial as well.

- Fill in your street address, city or town, state, and zip code, ensuring all information is correct for accurate correspondence.

- In the estimated tax voucher section, select the appropriate box indicating which form you plan to file: Form 1 Full-Year Resident, Form 1-NR/PY Nonresident/Part-Year Resident, or Nonresident Composite Return.

- Input the amount of this installment as referenced from line 12 of your estimated tax worksheet. Be sure to double-check this figure.

- Once all fields are completed, you can save your changes. Follow the instructions to download, print, or share your completed form as needed.

Complete your estimated tax form online today for a fast and secure filing experience.

Taxpayers can pay their taxes throughout the year anytime. They must select the tax year and tax type or form when paying electronically. ... For easy and secure ways to make estimated tax payments, use is IRS Direct Pay or the Electronic Federal Tax Payment System. IRS.gov/payments has information on all payment options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.