Loading

Get Fr 800m

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fr 800m online

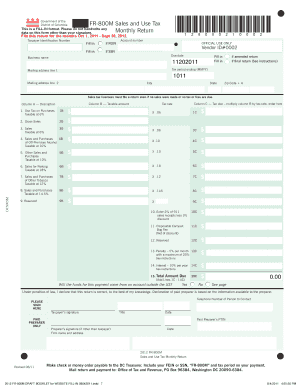

The Fr 800m form is essential for reporting monthly sales and use tax in the District of Columbia. This guide provides clear instructions to help you successfully complete the form online, ensuring accurate submission.

Follow the steps to effectively complete the Fr 800m form.

- Click ‘Get Form’ button to acquire the Fr 800m document and access it in the editor.

- Fill in the taxpayer identification number section. Enter your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as appropriate.

- Input your account number and verify the vendor ID provided in the document.

- Specify the due date for submission, ensuring it is accurate to avoid potential penalties.

- Complete the business name and mailing address sections, including the city, state, and zip code.

- For each taxable category listed, such as use tax on purchases and gross sales, enter the taxable amounts in the fields provided.

- Calculate the tax due for each category by multiplying the taxable amount by the applicable tax rate. Enter these amounts in the designated columns.

- For sections that ask for sales and purchases of alcohol, tobacco, and other items, fill them out as per your business transactions.

- Complete any reserved sections if applicable, and calculate any penalties or interest that may apply to late submissions based on the given rates.

- Add all calculated totals to find the total amount due, ensuring this figure is accurate.

- Select whether the payment will originate from an account inside or outside the US and provide relevant details.

- In the declaration section, confirm that all information is correct to the best of your knowledge and affix your signature.

- Ensure you include the telephone number of the person to contact regarding any queries related to the form.

- If a paid preparer assisted you, ensure their information is filled in correctly along with their signature.

- Once completed, save changes, download the form, print it, or share it as necessary based on your needs.

Complete your Fr 800m form online today for efficient management of your sales and use tax return.

Washington, D.C. sales tax details The Washington, DC sales tax rate is 6%, effective October 1, 2013. This is a single, district-wide general sales tax rate that applies to tangible personal property and selected services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.