Loading

Get Sc 40

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sc 40 online

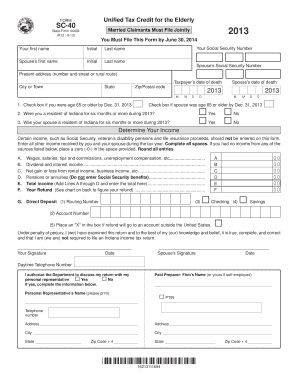

The SC-40 form is essential for claiming the Unified Tax Credit for the Elderly in Indiana. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring a smooth filing process for all users, regardless of their legal experience.

Follow the steps to successfully fill out the Sc 40 form online.

- Click the ‘Get Form’ button to obtain the SC-40 form and open it in your editor.

- Provide your first name, initial, and last name in the designated fields.

- Enter your Social Security Number and your spouse’s Social Security Number if applicable.

- Fill in your present address, including number and street, city or town, state, and zip/postal code.

- Indicate if you and your spouse were age 65 or older by December 31, 2013, by checking the appropriate boxes.

- Answer whether you and your spouse were residents of Indiana for six months or more during the tax year by selecting yes or no.

- Complete sections A through F by entering all applicable income received during the tax year. If any income type is not applicable, enter zero.

- After completing the income sections, calculate your total income and enter it in Line E.

- Determine your refund amount by comparing the figure on Line E to the provided chart based on your filing status and age.

- If you wish, provide your banking information for direct deposit, including routing and account numbers. Indicate the type of account.

- Sign and date the form in the designated areas for both you and your spouse if filing jointly.

- Optionally provide your daytime telephone number and authorize a personal representative if desired.

- Finally, save your changes, and download, print, or share the completed form as needed for submission.

Complete the Sc 40 form online to ensure you receive your Unified Tax Credit for the Elderly.

You have the following options to pay your tax: Send e-payment through state website. Mail payment to: Indiana Department of Revenue. P.O. Box 6117. Indianapolis, IN 46206-6117.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.