Loading

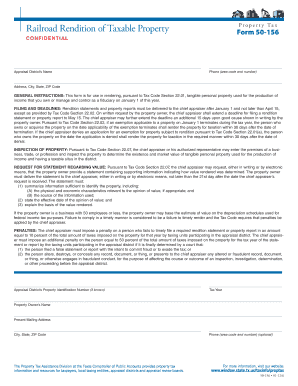

Get P R O P E R T Y Ta X Railroad Rendition Of Taxable Property Form 50-156 Confidential Appraisal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the property tax railroad rendition of taxable property form 50-156 confidential appraisal online

This guide provides detailed and user-friendly instructions for completing the property tax railroad rendition of taxable property form 50-156 online. Designed for individuals who own or manage taxable property, this comprehensive guide will help you navigate each section of the form with ease.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the appraisal district's name, followed by the phone number, and the complete address including city, state, and ZIP code.

- Indicate the tax year and the property owner's name. Ensure that your current mailing address is accurate to receive any important correspondence.

- Check the total market value of your property, selecting either under $20,000 or $20,000 or more.

- If your property value is under $20,000, you have the option to complete a different form (Business Personal Property Rendition of Taxable Property Form 50-144).

- Complete the sections for itemized property listings. For Item 1, provide details about real property, including location and estimated market values.

- For Item 2, detail the railroad corridor properties, including the number of miles and market values per mile as required.

- List personal property in Item 3, ensuring to provide descriptions and any relevant estimated market values.

- Affirm the status concerning your relationship with the property—confirm whether you are the owner, an authorized agent, or acting in a fiduciary capacity.

- Sign and date the document. If you are not the property owner and cannot confirm ownership, ensure to fill out the additional statement for accuracy.

- Upon finalizing all required information, review for completeness and accuracy before submitting. You may save changes, download, print, or share the form as needed.

Complete your property tax rendition form online today to ensure compliance and avoid penalties.

A rendition is a form that provides the Appraisal District with taxable business property information. The form must be filed by April 15th each year. Included in the form is the business name and location, description of assets, cost and acquisition dates and opinion of value for business personal property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.